Insurtech

Health insurer uses AI 'medical brain' to aid staff in decision-making

A health insurer is using an artificial 'medical brain' to improve its underwriting and claims.

Blog: Diary of an insurtech start-up, episode 2: Silicon Valley

James Stuart Clarke, head of sales and partnerships at Digital Fineprint, compares the start-up scenes of San Francisco and London in the second instalment of his behind-the-scenes look at insurtech disruption.

Allianz makes strategic investment in Lemonade

Allianz has made a strategic investment in US insurtech start-up Lemonade.

Identity fraud: Trading faces

With almost 173,000 reported cases last year, identity fraud is an ever-increasing problem. Insurers are taking a proactive approach to fight this pernicious problem

Chubb's Jeremy Miles on the battle between algorithms and service

Last month, The Economist magazine featured a provocative article on disruption of the insurance sector that examined how businesses are using technology to re-engineer the underwriting model.

Insurance M&As expected to focus on insurtech

The days of mega-mergers in the insurance industry may be behind us as consolidation activity has dropped significantly from the peaks of 2014 and 2015. The sector is contemplating this change of gear and steadying itself in the face of waves of global…

British Insurance Awards: 2017 shortlist revealed

Today we reveal the companies that will be in the running for the 23rd British Insurance Awards at the Royal Albert Hall.

Tech-driven commercial insurance broker Konsileo enters market

Tech-driven commercial insurance broker Konsileo has entered the market and is in the process of recruiting mid-market brokers.

Startup Trov secures $45m for expansion efforts

On-demand insurance provider Trov has secured $45m (£36m) of investment for its global expansion efforts.

Lloyd’s faces 'structural revolution' as market challenges drive change, says Macquarie

Lloyd’s will undergo a “structural revolution” as digital innovation and alternative capital sources impact the market, according to Macquarie Research.

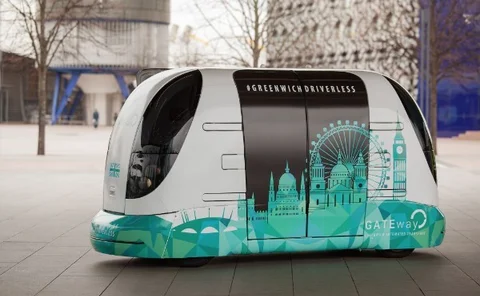

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

Lemonade expands to Illinois six months after New York launch

Lemonade has expanded to Illinois as part of its plans to expand nationwide and reach 97% of the US population by 2017.

Insurtech start-ups graduate from Accenture incubator

A series of insurtech start-ups have completed the Accenture Innovation Lab programme and are set to begin their seed funding rounds.

Blog: Engaging tomorrow's customers today

Insurance has traditionally been considered a grudge purchase, driven by the legal requirements for cover and a desire for financial protection. Indeed, 41% of respondents in a Consumer Intelligence poll said they thought of insurance as "a necessary…

Half of insurtech investment is in artificial intelligence and IoT

Investment into insurtech increased by more than 50% globally to nearly £15m last year, with the majority of deals involving artificial intelligence, a report found.

Over one third of insurance jobs at risk from robots

Artificial intelligence could place more than a third of jobs in the UK financial and insurance sectors at high risk, according to a report from PWC.

This week in Post: highs, lows and running with the wolves

It has been a week of highs and lows in our household. My son went on his first Cub sleepover and earned the honour of becoming a Sixer. I, meanwhile, returned to the X-ray machine.

CIBA: Cyber policies are evolving to meet expanding risks

Cyber policies are evolving to cover more risks but certain exposures remain underpriced, Allianz has warned.

The Cyber Insurer and Broker Assembly 2017 - as it happened

The Cyber Insurer and Broker Assembly took place on 23 March. Post's journalists reported live from the event.

Startup Bootcamp Insurtech partners with Zurich

Zurich has entered into a partnership with Startup Bootcamp and will be engaging with its portfolio of start-ups.

Interview: Guy Goldstein, Next Insurance

As Next Insurance launches today a chatbot allowing personal trainers to quote and buy insurance via Facebook Messenger, its founder and CEO Guy Goldstein tells Jonathan Swift how the American insurtech start-up plans on revolutionising the SME…

Brightside's Mark Cliff on becoming Mr Digital

I want to be Mr Digital. Frankly, this might be a step too far for many people who know me.

Simply Business dedicated to growing UK headcount following Travelers acquisition

Simply Business remains committed to growing staff levels in the UK following its acquisition by Travelers.