infectious-diseases

One Voice Group urges ABI and senior insurance executives to attend talks with 'open minds'

The Association of British Insurers missed the point in its response to a letter from One Voice Group, Stephen Gould, chairman of the hospitality representative body, told Post as he reiterated the call for leadership and engagement.

Blog: Global reinsurance market - what can we expect to see from 2020?

Very few people have 20/20 vision and there is no exception to this when looking forward to what impact the year 2020 will have on the reinsurance market writes Gavin Coull, London Forum of Insurance Lawyers executive committee member and partner at…

An open letter to John Neal, CEO of Lloyd’s of London

Nir Kossovsky, CEO of Steel City Re, pens an open letter to John Neal, CEO of Lloyd's of London, on the reputational crisis facing the insurance industry.

Law firm names Hiscox and RSA as BI class action litigation targets

Law firm Edwin Coe has invited businesses that have been denied business interruption cover by Hiscox and RSA to join two group claims it is putting together, as litigation against insurers by rejected policyholders cover continues to proliferate.

Trio of insurtechs raise almost £20m as market warned of slowdown in investments

A trio of insurtechs have confirmed early-stage fund raising of almost £20m only one week after the market was warned to expect a slowdown in investment due to Covid-19.

Insurance Covid-Cast episode 15: Has there been a rise in cyber threats and scams during coronavirus lockdown?

In the latest episode of Post and Insurance Age’s video series we gathered together a group of cyber experts to discuss how hackers and scammers are using Covid-19 to prey on people’s thirst for knowledge and information at this time.

Educating and representing during Covid-19: How insurance trade and training bodies are operating remotely

There has been a lot of focus on how different insurance companies have responded to the Covid-19 pandemic, but what about the representative and educational organisations that are part of the lifeblood of the sector? Post content director Jonathan Swift…

Aviva predicts £200m in Covid-19 BI claims

Aviva has predicted it will see £200m in business interruption claims net of reinsurance.

My life in quarantine: QBE's Chris Wallace on fundraising efforts to support dementia sufferers

Chris Wallace, executive director for European markets at QBE, shares his experience on working on the Insurance United Against Dementia campaign alongside other IUAD board members are lobbying various groups, volunteering and doing self-isolation…

Hospitality businesses gear up for group action against Aviva and QBE

Aviva and QBE face multimillion pound claims from a group of hospitality businesses that were denied cover when they sought to recoup pandemic-related losses.

Ferma mulls call for pan-European pandemic solution

Future events causing non-damage business interruption losses on the scale seen during the coronavirus pandemic could require a pan-European approach in addition to national pools and solutions, the president of the Federation of European Risk Management…

Blog: The future role of insurers in a post Covid-19 society

Paradoxically, uncertainty is the one certainty in today’s pandemic regime - the insurance industry is facing a far more indeterminate present and future writes Paul Coleman, managing director of NPA Insurance.

Premium finance bosses hail 'smooth' transition to latest guidance

The introduction of further guidance on premium finance by the Financial Conduct Authority including three month payment deferrals for customers hit by the economic impact of the coronavirus pandemic has gone well according to market players.

Insurance Covid-Cast episode 14: Newsmaker special with Crawford & Company group chief executive Rohit Verma

In this Insurance Post and Insurance Age video cast brought to you while our journalists are working from home, we present the latest in a series of newsmaker specials focused on the people behind the lockdown headlines.

Analysis: Protecting pets

Over the past decade, the UK’s pet insurance market has seen substantial growth with 7.7 million pet insurance customers in the country. But amid so much uncertainty due to the Covid-19 pandemic, what reassurances are insurers providing to customers who…

Beazley looks to raise £247m through share placement

Beazley hopes to raise £247m through the placing and subscription of new shares representing 15% of the insurer’s existing issued share capital.

Insurance sector targets £100m with Covid-19 charity launch

The UK insurance and long-term savings industry has launched the Covid-19 Support Fund with £82.5m of its £100m target already pledged to help people hit hardest by the crisis.

Hiscox accused of confirming businesses' coronavirus cover then rejecting claims

Some businesses that have had coronavirus-related claims rejected by Hiscox were told in writing prior to lockdown that they would be covered, according to an action group challenging the insurer.

Hiscox Action Group to launch £40m arbitration claim 'within days'

An action group of 400 Hiscox business insurance policyholders is to launch an “expedited arbitration claim” against the insurer worth almost £40m.

Allianz's Simon McGinn on sustainability

With nations forced into lockdown, economies struggling and health systems under extreme pressure, the Covid-19 pandemic is one of the biggest challenges any of us has ever faced. But the crisis could also prove to be a much-needed catalyst for action on…

FCA invites broker and policyholder input as it builds BI test case

The Financial Conduct Authority has invited policyholders and brokers with unresolved Covid-19-related disputes with insurers over business interruption polices to put forward their arguments for why claims should be paid.

Zurich expects $750m Covid-19 hit

Zurich has predicted a $750m (£614m) property and casualty hit over the course of the year due to the coronavirus pandemic.

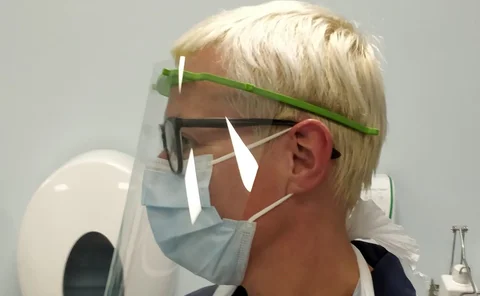

My life in quarantine: Zurich's Andrew Coe shares how he has been 3D printing PPE for NHS workers

Engineer surveyor at Zurich Insurance and amateur 3D printing enthusiast Andrew Coe explains how he has been dedicating his evenings in lockdown to printing personal protective equipment for his wife, an NHS worker as well as his local university.

Regulator to require payment deferrals for insurance customers from Monday

The Financial Conduct authority has confirmed temporary measures aimed at helping insurance customers who find themselves in financial difficulty due to the coronavirus pandemic, including requiring payment deferrals.