Home insurance

Private equity firm buys 50% of Policy Expert

Policy Expert bosses have claimed the home and motor insurance provider is “positioned for growth” as private equity firm Cinven has bought a 50% stake in the business from the Abu Dhabi Investment Authority.

Aviva’s cyber partnership; Clear buys Accelerate; Bupa's insurance CEO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Direct Line ‘turnaround underway’ as insurer returns to profit

Direct Line Group has returned to profit after shedding almost 488,000 motor customers in the first half of this year.

Esure to ‘soft-launch’ multi-product policy in 2024

Esure CEO David McMillan has shared how he hopes to grow the firm by expanding its reach in multi-product insurance.

Car and motorcycle complaints hit record levels

Financial Ombudsman Service statistics show a record number of new cases for car and motorcycle insurance at the start of 2024.

Carbon neutrality in home repairs to cost £9.8m

Carbon neutrality in UK domestic property claims repairs would cost the industry £9.8m, according to Sedgwick.

Consumer group warns of insurers overcharging vulnerable customers

The Financial Services Consumer Panel has published a research paper raising concerns that vulnerable customers may be at risk of overpaying for insurance.

Fraudster who repeatedly targeted RSA is jailed

A man who repeatedly filed fake home insurance claims to RSA for broken phones, laptops and televisions using a variety of false identities, has been jailed for 20 months.

Esure on track to return to profit in 2024

Esure CEO David McMillian has stated the insurer is on track “for strong profitability for the full year” after the provider completed its IT transformation and shrunk its home and motor book by 12.4% in the first half of 2024.

Aviva’s Storah reveals what to expect next from the provider

Aviva UK&I general insurance CEO Jason Storah, along with his chief financial officer Stephen Pond, share what lines they expect to grow the most in the latter half of 2024 and outline their approach to pricing as inflation heads closer to 2%.

Admiral showers employees with shares as profits soar

More than 12,500 Admiral employees will each receive free share awards worth up to £1800 under the employee share scheme, based on the interim 2024 results.

Aviva’s Blanc plans to further grow GI business

Aviva Group CEO Amanda Blanc expects to further grow the provider’s general insurance business by matching her organisation’s ambition with the Labour Party’s agenda and by deepening relationships with existing customers.

Cost of insuring ground floor flats surges by 42%

The cost of insuring ground floor flats increased most significantly of any property type between April and June this year with premiums climbing by 42% from £178 to £252, according to Compare the Market.

Property insurance payouts hit record quarterly high

Insurers paid £1.4bn in claims for property damage during the second quarter of the year, according to the latest data from the Association of British Insurers (ABI).

Defaqto reveals top car, home, travel and pet insurers

AA, Post Office Money, Virgin Money and Animal Friends have been named by Defaqto as the top providers for 2024–25 across the four major personal lines of insurance.

Big Interview: Charles Offord, Co-op Insurance

Since the turn of the century, Co-op Insurance has weathered more “near-death” experiences than any other financial services company in the UK.

Addressing financial stress and its implications for insurers

Alison Williams, managing director of Prestige Underwriting, highlights what insurers need to do to address the needs of a growing number of non-standard consumers caused by the cost-of-living crisis.

Tackling the growing issue of fake insurance adverts

As a growing number of road traffic accident victims are falling foul of scammers pretending to be insurers, Fiona Nicolson explores what is being done to stop companies advertising false contact numbers on search engines to trick customers into filing…

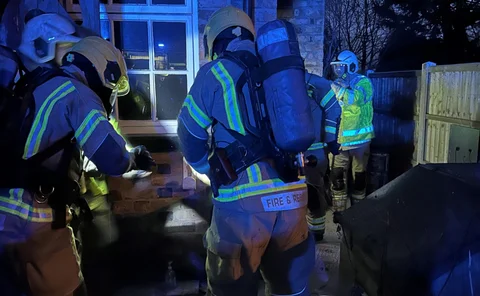

E-bike battery legislation ‘warmly’ welcomed

The UK government has announced its intention to legislate to reduce the fire risks associated with electric power-assisted bicycles and lithium-ion batteries.

Allianz’s PL motor product; Voyager is acquired; BMS’ growth officer

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Esure loses customer claim in ‘isolated’ incident

Esure has been accused of negligent customer service after BBC’s The One Show highlighted two claims from policyholders who struggled to get in contact with the insurer following accidents.

Claims ‘hell’ with Policy Expert causes mother to set up group

A mother-of-two, who has been through a 17-month battle with Policy Expert following a fire at her home, has set up an action group to help “other families going through hell with claims.”

Why are HNW MGAs dropping like flies?

After numerous MGAs operating in the high-net-worth space have either been sold or gone into run-off over the last few years, Scott McGee asks what does it take to survive in this space?

Kwik Fit's comeback; London Market’s world record; Ageas’ risk officer

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.