Home insurance

Ageas sees payout for refusing to gamble on Ogden

Ageas UK saw a £27.6m bounce as a result of the discount rate change, offsetting large motor losses for the half.

Q&A: Homeserve Labs chairman, Mark Wood

Homeserve Lab’s Leakbot is currently live and working with a wide range of insurers in the UK, Europe and the US. Post spoke to the company’s non-executive chair, former Axa UK CEO and Prudential UK and Europe CEO Mark Wood, to hear about its plans for…

Blog: Home history data may build a better picture for pricing

Pricing practices in the home insurance market are under scrutiny and according to Jay Borkakoti, director, home insurance, UK and Ireland, LexisNexis Risk Solutions insurers need to use claims history data to better their understanding of property risk.

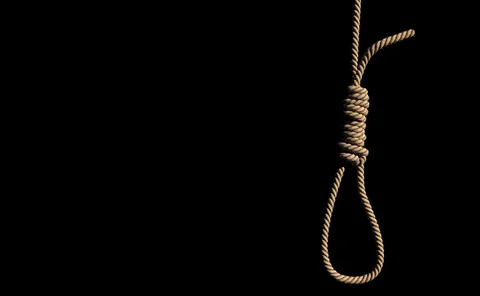

Analysis: The future of pricing - Tightening the noose

The dual pricing noose is slowly tightening around the insurance industry’s neck. Its laudable attempts to escape from the regulatory hangman seem increasingly futile as the pressure is mounting on the Financial Conduct Authority to take action.

Home premiums could rise 22% if FCA acts on dual pricing

Home insurance premiums could rise 22% for new customers if the regulator moves to axe dual pricing, analysts have warned.

Allianz to integrate L&G into LV

Allianz will transfer Legal & General’s general insurance business to LV once it completes its takeover at the end of the year.

Home insurance premiums drop despite higher claims

Average home insurance premiums have dropped 1.2% in the past year to £134, despite a rise in subsidence claims, according to the latest report.

Urban Jungle secures £2.5m in seed funding round

Urban Jungle, an insurtech targeted at “generation rent”, has raised £2.5m in a seed funding round.

Flagging personal lines see Covéa's profits slashed

Covéa Insurance saw its underwriting profit slashed to £1.8m in 2018 compared to £12.4m in 2017, as its personal lines business felt the impact of claims inflation and adverse weather.

Customers increasingly looking to credit to pay for premiums: research

Insurance customers are increasingly relying on credit to pay premiums, with nearly one in three planning to use more credit this year, research found.

RSA's David Germain on keeping up with technology

Insurance has a long history but as David Germain, chief technology officer for RSA, explains, the sector still needs to keep up with technology.

Neos partners with American Family Insurance to launch smart home protection service in US

US-based insurer American Family Insurance will deploy Neos smart home technology and related products and services to launch smart home protection service in the US.

Zurich ‘temporarily’ pulls out of direct home insurance

Zurich UK has announced it has ‘temporarily withdrawn’ from the direct home insurance market, as it explores other options.

LV in U-turn over home business

LV plans to build on the home book it picked up from Allianz business transfer, despite losses in the segment last year.

Insurance fraud rises 27% finds Cifas

The number of fraudulent insurance claims have soared by 27%, fuelled by rises in household and motor fraud.

So-sure plots home insurance launch early next year

Exclusive: Mobile phone insurance insurtech So-sure will look to branch out into home insurance early next year and is mulling international expansion.

Generali Italia to invest €300m in growth

Generali Italia has launched a three-year growth strategy that will see the company invest €300m (£258m) in its own business, with a renewed focus on digital and tech-driven services and prevention.

Interview: Janet Connor, The AA

A lot has changed at the AA in the five years since Janet Connor, now director of insurance, joined the organisation. She explains to Jonathan Swift how an investment in data and technology – alongside the relaunch of its insurance company and board…

This week in Post: Sun, scams and Brexit

As we draw closer to the start of spring, the UK has seen unseasonably warm weather, with temperatures climbing into the double digits in recent days. But it’s not just the weather that’s heating up.

Ageas UK says long goodbye to Ogden impact as CEO Watson hails ‘strong’ motor performance

Ageas UK saw a threefold increase in profitability in its 2018 full year results, reporting a profit of £76.7m compared to £25.4m in 2017.

Insurtech diary: Trekking the glacier

In the last instalment in our insurtech series, Buzzgroup founder and CEO Becky Downing, reflects on the past 12 months and the story of Buzzvault’s launch.

Cavere Group launches broker

Cavere Group has launched an intermediary business primarily focussed on home insurance.

Insurtech diary: Confessions of an insurtech pricing guy

As head of pricing for Buzzvault, Paul Vinten is keen to unleash his inner data scientist on the firm's new product and see which rabbit hole the figures might take him down.