General Data Protection Regulation (GDPR)

DRP unveils grossing up and pay gap bonus allegations in Jelf legal wrangle

David Roberts & Partners has denied the client and team poaching claims by Jelf in a High Court case and accused the Marsh-owned business of having a "toxic" work atmosphere and grossing up premiums, while a counterclaim from one defendant alleged human…

Former branch director sues Jelf for invasion of privacy over Facebook messages

Jason Lauchlan, a former branch director of Jelf’s Malton office, is seeking compensation for what he alleges was an “unlawful” breach of his privacy after Jelf obtained and shared Facebook messages between him and another former employee.

FCA vulnerability guidance ‘far from enough’ warns former retail GI boss

The Financial Conduct Authority's guidance to help firms understand and assist vulnerable customers may be a start "but is far from enough”, the watchdog's former retail general insurance boss has cautioned.

Blog: Holding the line - how networks are helping insurers manage the pressure

Millions of people around the world continue to work from home as part of measures to restrict the spread of coronavirus. But with social restrictions easing in many countries across Asia and Europe, thousands of brokers who swapped the physical trading…

Blog: Data lakes - what are the benefits to the insurance industry?

Increasing interest in big data is a growing trend within financial services and the insurance business is no exception, according to Alexandra Foster, director, insurance, wealth management and financial services at BT.

Blog: 2020 – a year of tipping points

2020 could prove to be a year of significant risk tipping points for insurers, many of them driven by fast-paced political and cultural change says Simon Laird, global head of insurance at RPC.

Aviva says no personal data shared in emails that wrongly called customers Michael

Insurer Aviva has said there was ‘no issue with personal data’ in thousands of emails it sent out mistakenly calling customers Michael.

Microsoft data breach: Cyber experts warn of knock-on claims effect

Microsoft’s data breach, which saw details of a reported 250 million customers made available online, could leave insureds facing knock-on phishing attempts and the tech giant facing a fine.

Analysis: Embracing data ethics

With the increasing use of machine-learning models, the data being inputted into these models raises a number of ethical questions, but how are insurers addressing these potential issues?

Scrap target times and frivolous bureaucracy to help vulnerable customers, suggests DLG claims head

Insurers need to ditch standard practices like target times in contact centres and avoid unnecessary bureaucracy if they are to meet the needs of vulnerable customers, according to Direct Line Group managing director of claims Jessie Burrows.

Huge data breach claims necessitate cyber insurance rethink, warns Kennedys

Data subject claims are on the rise and will be “the next in a long line of mass litigations” producing “exposures in the tens of millions”, according to Kennedys.

Analysis: Telematics - telling it as it is?

Fabricating a motor insurance claim used to be as simple as arranging for a mate to drive into your car but with today's new technology, Veronica Cowen explains how much harder insurers are making it for the fraudsters.

Special Report: The future of personal lines insurance: Expert view

The insurance industry needs to understand the demands of its future customers if it is to satisfy their expectations. EXL’s head of UK and Europe and SVP Insurance, Nigel Edwards explains how smarter insurers will adopt personalisation and a…

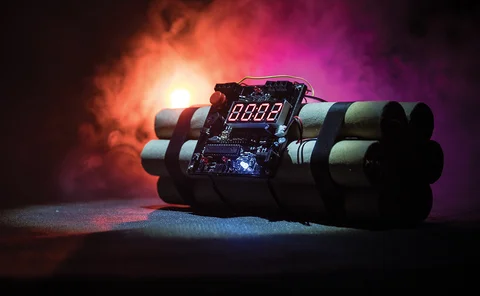

Spotlight: SME market: SMEs and cyber risk - a ticking time bomb

SMEs are a prime target for cyber criminals because they are believed to have limited resources and employ less technically aware employees than larger enterprises. Despite this, these businesses, their insurance providers and brokers are not assessing…

Former claims management company boss fined over £1.4m data scam

A former claims management company boss has been found guilty of illegally obtaining people’s personal data and selling it to solicitors.

Allianz's Stephanie Smith on cultural transformation in the industry

One year on from the introduction of the General Data Protection Regulation and most companies have successfully adopted the new requirements. But Stephanie Smith, chief operating officer at Allianz, says while hefty fines and the risk of reputational…

Two out of five brokers have never sold a cyber policy

Two out of five brokers have never sold a cyber policy, owing to both a lack of confidence and customer reluctance, research found.

Roundtable: Making data fit for compliance and regulatory purpose

The use of data is widespread but where insurers are on their integration journeys can be very different. Post, in association with Marklogic, brought a panel of experts together to discuss best practice in this area including effective compliance and…

Blog: The shift in healthcare delivery - how can insurers respond to changing customer needs?

The provision of healthcare is about to change beyond recognition. Tim Boyce, healthcare team leader at CFC Underwriting, explains how technology is set to transform the way medical professionals treat patients and develop cures.

Blog: Turning the tide on account takeover fraud

Many of us have either experienced fraud, seen friends who have fallen victim to it or witnessed the direct results in our workplaces. Shaun Smith, Iovation sales executive, explains why it's no surprise that one of the fastest growing fraud types in the…

Blog: Cyber future will come down to communication

With the nature of cyber attacks constantly changing Madeleine Shanks, associate partner at Clyde & Co, explains that dialogue between customers and their insurers has never been more important to ensure that cover is proportionate.

Webinar: Removing the shackles of heritage technology to become fit-for-purpose

The burden of legacy or heritage technologies is not a new issue for the insurance industry.

Ecclesiastical's John Blundell on cracking the cyber code

Cyber crime has hit the headlines but sales are still down. Ecclesiastical's UK general insurance managing director John Blundell explains why the sector needs to break down difficult wordings and better explain both risks and policies to clients to make…

This week: What does the fox say?

Brightside’s new managing general agent Kitsune takes its name from the Japanese word for fox. The animal is much admired in Japanese folklore for its intelligence and supernatural abilities – characteristics all the insurance companies that announced…