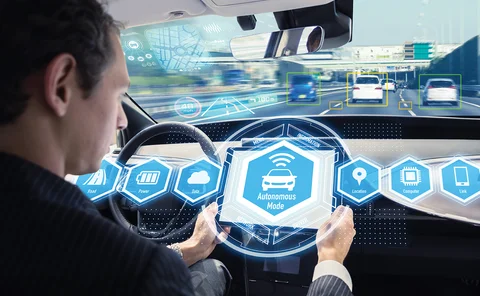

Driverless cars

IUA weighs in on consultation over driverless cars

The International Underwriting Association has called for laws on driverless cars that would require drivers to keep their eyes on the road at all times.

Trade Voice: Bila's Ozlem Gurses on motor passenger insurance

How do passengers 'use' motor vehicles? Ozlem Gurses, reader in insurance and commercial Law at King’s College London and British Insurance Law Association committee member, explains how the law sees this question when it comes to insurance.

Penny Black's Social World: January 2019

CSR, charity week and clearing gardens

Blog: How can insurers keep up when the future is being created every day?

Insurers will inevitably retain insurance as their core offering. But must act more like venture capitalists and develop innovation cultures to succeed according to Geoff Knott, director, Ninety Consulting

Analysis: Review of 2018

The spectre of Brexit loomed large over the insurance sector this year, and although the picture is still no clearer in terms of how the UK market will continue to trade with Europe after 29 March 2019, significant merger & acquisition activity was among…

Legal consultation launched into driverless cars

A wide-ranging consultation has been launched into the legal reforms surrounding driverless cars.

Q&A: Matthew Avery and Graham Gibson, Thatcham

As cars move towards automation, Jen Frost spoke to Graham Gibson, chairman of Thatcham Research and Allianz’s chief claims officer, and Matthew Avery, director of insurance research at Thatcham Research, about how the UK research centre is working with…

Axa's David Williams on why insurers need to drive autonomous car initiatives

Motor insurers must play an active part in the schemes that develop and test autonomous vehicles, despite the many issues that need to be ironed out, writes David Williams, technical director at Axa.

Allianz Partners launches three new 'innovation centres'

Following the launch of its Automotive Innovation Centre in 2014, Allianz Partners has created three further 'innovation centres'.

Driverless experts: Autonomy to lead to ‘brutal’ insurer consolidation

Autonomy experts expect the advent of driverless cars to result in massive amounts of consolidation and change in the motor market, with mid-size personal lines players most at risk.

Ageas' Andy Watson on pushing for a realistic Brexit plan

Insurers need to keep pushing their priorities now for an effective Brexit plan, writes Andy Watson, CEO of Ageas UK, urging the industry to work with the government to achieve a realistic negotiating strategy.

Blog: How will Paul Geddes' decade at Direct Line Group be remembered?

When Paul Geddes took over the role of CEO of Royal Bank of Scotland’s insurance business in July 2009, moving from the retail arm of the bank, and replacing Chris Sullivan, I cannot remember many getting too excited.

Automated and Electric Vehicles Bill passes through parliament

The Automated and Electric Vehicles Bill has passed through parliament and gained royal assent.

Thatcham CEO Shaw steps down due to ill-health

Thatcham Research CEO Peter Shaw is stepping down from his role with immediate effect due to ill-health.

Aviva's Maurice Tulloch on distracted driving becoming the new drink-driving

Drinking and driving is simply not acceptable to today's society. Why then, asks Maurice Tulloch, CEO Aviva International Insurance, is the same stigma not yet attached to using a phone will driving?

Interview: Simon Walker, 1st Central

It’s been 10 years since motor broker 1st Central launched in the UK, with policies sold exclusively over the phone or the internet. Simon Walker, who became CEO of parent company First Central Group in January, expects online giants like Amazon or…

Blog: Not taking hands off the wheel just yet

UK laws, roads and infrastructure are getting ready for self-driving cars but motorists remain reluctant to adopt this technology, points out Simon Walker, group CEO of First Central.

Regulation Q&A: From GDPR to IDD, Brexit to the future of the PRA, what do insurers really think?

The regulatory landscape is constantly evolving, With this in mind, Post asked a number of senior insurance figures about some of the most pertinent changes that are afoot from GDPR to the IDD, and how they would like the situation to develop in a post…

Spotlight on ADAS: Why ADAS is not a fit and forget system

With more Advanced Driver Assistance Systems being installed on cars, Alistair Carlton, technical manager at National Windscreens, says insurers shouldn't underestimate the demand for ADAS calibration.

Spotlight on ADAS: Is everyone ready for ADAS?

As assistance systems are making cars safer, but also more costly to repair, insurers would love a database listing which features are fitted on which vehicles - but motor manufacturers aren’t sharing that information yet

Driverless car data access a 'big priority' for ABI

Insurers need to have access to the accident data produced by connected cars, a conference heard.

Clearer definition of autonomous driving needed: Thatcham

The government needs to clearly define what constitutes autonomous driving in order that insurers can properly determine liability, a conference heard.

MIB could help OEMs share accident data with insurers

The Motor Insurers’ Bureau could act as a platform for car manufacturers to share with insurers accident data generated by autonomous vehicles, a conference heard.

Axa's Williams warns motor insurers against becoming obsolete

Motor insurance is going to be "massively impacted” by the advent of autonomous vehicles, a senior Axa executive has warned.