Gibraltar

MGA boss warns over sliding scale commission deals

The use of sliding scale commission arrangements in the managing general agent space could have the same disruptive impact on the fleet and commercial vehicle market as past withdrawals of unrated capacity.

Top 100 UK Insurers 2024: Drastic turnaround in profitability

Major players pulling out or significantly scaling back their personal lines propositions, while others saw commercial lines profits soar, has significantly shaken up Insurance Post’s Top 100 UK Insurers rankings in 2024, according to Ben Diaz-Clegg,…

Zego co-founder Harry Franks departs insurtech

Zego co-founder and former CEO Harry Franks has stepped away from the insurtech, Insurance Post can reveal.

UK bolsters ‘special relationship’ with Gibraltar

Melissa Collett, CEO of Insurtech UK, shares how Gibraltar’s “speed to market” offerings have won over UK insurtechs as they seek authorisation.

Utility Warehouse launches Gibraltar-based insurer

The Utility Warehouse has launched its own stand-alone insurance company, as it seeks to make a greater push into the financial services market.

Farewell Gibraltar, hello PRA - is the tide about to turn for new UK-regulated insurers?

Content Director's View: With non-standard motor insurer Lumun looking for Prudential Regulation Authority authorisation, Jonathan Swift asks whether we might be entering a new dawn for home grown insurance companies.

Gillighan departs Somerset Bridge and Southern Rock

Chris Gillighan, the managing director of Somerset Bridge’s managing general agent and Southern Rock’s in-house insurer, is understood to have left both businesses.

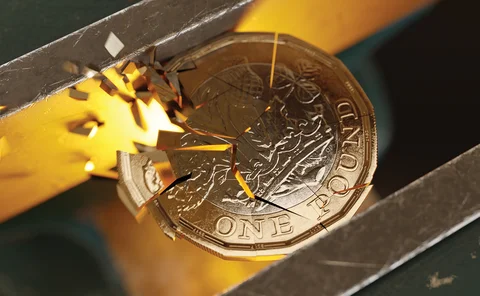

Analysis: Unstable firms are falling off the Rock

Post looks at a series of insurer failures in Gibraltar – and asks what the future will look like for existing and new entrants.

Briefing: Biba and Markerstudy - a litmus test as to why it is good to bury beef and move on

Katy Perry and Taylor Swift, Drake and Meek Mill, and now Markerstudy and the British Insurance Brokers' Association. Jonathan Swift looks at why this latest reconciliation should make the 2022 Biba Conference an even more highly anticipated event than…

MCE CEO Edwards pledges legal action against Gibraltar regulator

MCE Insurance CEO Julian Edwards has pledged legal action against the Gibraltar Financial Services Commission following the appointment of administrators at MCE’s Gibraltar-based insurer.

Gibraltar regulator denies accusations made against it by MCE

The Gibraltar Financial Services Commission has denied accusations made against it by MCE Insurance earlier this week in the wake of MCE’s Gibraltar-based insurer being put into administration.

MCE claims recovery proposals for Gibraltar insurer were declined by regulator

MCE Insurance has alleged that it tabled proposals to “immediately meet any shortfall” in the capital requirements of its Gibraltar-based insurer but these were declined by the Gibraltar Financial Services Commission ahead of the provider's collapse last…

Mulsanne legal claim a bid to 'stifle Marshmallow at birth' argues insurtech in court face off

Marshmallow and Mulsanne's legal battle began this week, with the parties facing off in a London court.

Marshmallow accused of sharing 'personal data' with reinsurers in Mulsanne court battle

Mulsanne and Marshmallow took to a London court this week to thrash out allegations around contract breaches and misuse of confidential information.

FSCS general insurance compensation falls as shadow of Enterprise's collapse recedes

The cost of compensating customers of failed general insurance companies through the Financial Services Compensation Scheme has fallen for a second year running, with both the scheme’s GI provision and distribution classes seeing reduced payouts year-on…

Marshmallow denies trade secrets theft and refutes Confused data rating engine claim

In an ongoing legal battle Marshmallow has hit back in its defence document against Mulsanne, denying that it used Mulsanne’s “confidential information” to build its underwriter’s ratings engine and rebuffing suggestions that its underwriting system was…

IPO inevitable for 'reluctant unicorn' Zego: CEO Sten Saar

Zego, now valued at $1.1bn (£792m), has become the UK's first insurtech 'unicorn' with an initial public offering "inevitable" but not on the immediate horizon, the insurtech's CEO and co-founder Sten Saar told Post.

Gibraltar-based Prometheus Insurance enters administration

Gibraltar-based Prometheus Insurance Company, formerly trading as Tradewise Insurance Company, has entered administration.

Loss-making Markerstudy sniffing out investors as loan discussions continue post-deadline

Managing general agent Markerstudy made a loss in 2019, with discussions ongoing around its near £200m debt to Qatar Re.

Failed Elite ATE policies disclaimed

The administrators of Elite Insurance have disclaimed all but two after the event insurance policies underwritten by the insurer.

Intelligence: Captives - Risk appetite shift threatens change in composite market

As the spectre of a hard market looms and captive insurance options look more attractive, Post investigates the impact this will have on the commercial insurance market, particularly if the hard cycle is prolonged and the corporate appetite to retain and…