Risk Management

Claims: Providing a personal service

Brokers need to stand out in a competitive market and claims service is a way to make a real difference. Being there to advise, intervene – and to turn the heat up if necessary – can mean the world to a grateful client.

Allianz's Neil Clutterbuck on transforming motor insurance in the cloud

Harnessing the power of cloud computing can offer many business benefits in terms of data storage and processing, accessibility and cost. But with potential risks alongside the benefits, the opportunities it offers the insurance industry are still up for…

Blog: How to reduce litigation costs

Very few insurers effectively and proactively manage the relationship and performance of their panel law firms says Caroline O’Grady, partner at Coote O’Grady.

Europe: Insuring robots (and against robots)

Robots are becoming ubiquitous. Do we need specific insurance? And do they?

Blog: Driverless cars, potential for cyber mayhem?

Nothing is truly resilient against hacking. There’s always a trade-off between utility and the cost of protecting those systems according to Mark Hawksworth, technology specialist practice group leader at Cunningham Lindsey.

Brand reputation is top risk to companies worldwide

Brand reputation and damage is the top concern for business across the globe according to survey findings from Aon.

AIR Worldwide launches cyber risk aggregator tool

Catastrophe modelling firm AIR Worldwide has launched a cyber risk modelling tool to estimate potential insured cyber losses across an insurer's portfolio.

XL Catlin's François-Xavier d’Huart on opportunities for multinational insurers in France

French risk managers are less concerned with the domestic rise of populism than with providing their business with multinational cover, explains François-Xavier d’Huart, head of client and broker management, France, for XL Catlin.

Trade voice: CILA'S Malcolm Hyde on business ethics

Business ethics has become increasingly important in recent years for many reasons, including increased stakeholder scrutiny. This is not surprising in the light of financial institutions’ scandals, the MPs’ expenses scandal and perhaps the influence of…

Chubb's Jeremy Miles on the battle between algorithms and service

Last month, The Economist magazine featured a provocative article on disruption of the insurance sector that examined how businesses are using technology to re-engineer the underwriting model.

Blog: H&S obligations for construction subcontractors

The recovery of the construction sector to pre-2008 levels in some regions provided welcome news at the start of 2017 to those supporting contractors in the UK. However, with an increase in construction work, there is a heightened pressure for skills…

Blog: How to destroy data securely

As an insurance company, it is absolutely essential to take extra care when destroying documents or materials containing any sort of personal or financial information.

Blog: IoT 2017 - It's not all about data

As an insurer, understanding the Internet of Things and solutions it offers to our customers is one of our key priorities. But we also know that if we only think about IoT and insurance from one perspective, it can lead to the wrong answer. We need to…

Blog: Risk of flooding will not decrease without collaboration

As an insurer, we do unfortunately see first-hand the devastating impact flooding can have on homes and livelihoods.

Kieran Rigby appointed as president of Crawford International

Kieran Rigby has been appointed to president of Crawford international, encompassing the UK, Europe, Asia-Pacific and Latin America.

British Insurance Awards: 2017 shortlist revealed

Today we reveal the companies that will be in the running for the 23rd British Insurance Awards at the Royal Albert Hall.

Q&A: David Nayler, British Insurance Law Association

David Nayler took the chair of British Insurance Law Association in October last year, a body whose membership derives from brokers, insurers and legal firms. He has worked at Aon for 11 years, most recently as head of financial and professional, legal…

Terrorism and political risk threat increases worldwide

Businesses with domestic and international footprints face an increasing threat of terrorism risk as Western countries experience a sharp increase in such attacks, according to risk analysts.

Tech-driven commercial insurance broker Konsileo enters market

Tech-driven commercial insurance broker Konsileo has entered the market and is in the process of recruiting mid-market brokers.

RMS expands cyber risk models to include physical damage

RMS has expanded its range of cyber models to include cyber physical models to help insurers weigh up the cost of risk.

John Ludlow to become Airmic CEO as Hurrell steps down

John Ludlow will replace John Hurrell as CEO of Airmic, to come into effect from 13 June 2017

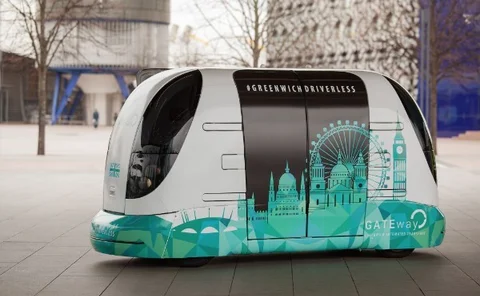

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

FM Global launches interactive global flood map

FM Global has launched its interactive global flood map for executives and risk managers.

In Depth: Using lie detectors to root out fraud

How broker Only Young Drivers is taking a novel approach to application fraud