United Kingdom (UK)

Ex-Sure Thing boss Devine made CEO at Ceta owner

Brendan Devine has been appointed CEO of Atec Group, which trades under the brand names Ceta Insurance, Arkel Underwriting and Insure My.

BGL's Peter Thompson on combating insurance fraud

Detecting and and deterring insurance fraud is a priority for many in the insurance industry. Peter Thompson, BGL Group’s CEO for insurance, distribution and outsourcing, looks at what’s next in the industry's fight against insurance fraud and reflects…

FCA versus insurers as test case showdown begins

It was today confirmed up to 370,000 policyholders may be affected by the Financial Conduct Authority's High Court case, which aims to decide on the validity of business interruption cover during the coronavirus outbreak.

Biba welcomes FCA consultation on SMCR deadline extension

The consultation by the Financial Conduct Authority on extending the deadline for the implementation of conduct rules is “welcome news”, according to David Sparkes, head of compliance and training at the British Insurance Brokers’ Association.

Wedding policyholders in ‘limbo’ despite message insurance would pay out

Great Lakes faces calls to pay out on wedding insurance after message on UK General-owned Weddingplan’s website suggested policyholders would be entitled to claim as long as cover was purchased pre-lockdown in ‘a particular area’.

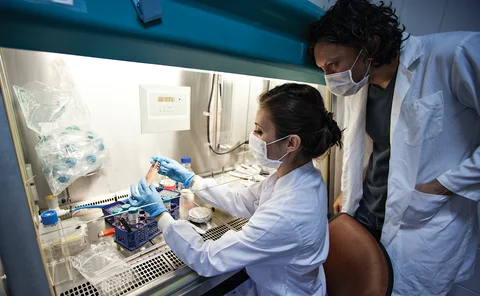

In-depth: How the life sciences sector is supporting the fight against Covid-19

The industry has found itself under the spotlight for all the wrong reasons during the Covid-19 pandemic. However, one area where it should be singing its praises is life sciences. Post investigates how brokers and insurers have supported the quest for…

180 years: Hurricanes in history

PREMIUM: The insurance industry has suffered very large losses from natural disasters over the past two centuries and this still remains a problem today, with 409 natural catastrophe events totaling $232bn in losses in 2019. Post looks at some of the…

ABI and Biba tout 'postive impact' of voluntary action on dual pricing

Voluntary initiatives launched in 2018 to address dual pricing are “having a positive impact”, the Association of British Insurers has claimed amid suggestions that the industry needs to go further and do so quickly.

PIB reveals £75.6m acquisitions bill for 2019

PIB Group’s bill for buying five companies last year was £75.6m, according to a filing at Companies House, which also revealed the results of stress tests to assess the impact of Covid-19.

Insurers haul brokers into FCA BI case again

A joint skeleton argument attacks the FCA’s stance that SME customers are not sophisticated insurance buyers because they used brokers and slams Contra Proferentem as “restrictive” and “out of step”.

Barnaby Rugge-Price appointed chair of Howden Broking Group

Howden Broking Group has appointed Barnaby Rugge-Price as chair returning to the helm of the broking business from his recent position as CEO of Hyperion X.

Insurance industry pays respects to former Zurich claims manager Kerry Woolley

Kerry Woolley, 38, was found dead in her flat in Solihull, West Midlands, with a knife wound to her neck on Sunday and her ex-boyfriend has been charged with murder.

Government accused of missing the point on homeowner flooding support

Government flooding funding "misses the point" on homeowners, it was alleged, as £5.2bn was pledged towards various initiatives.

Blog: The legalisation of rental e-scooters and its impact on the insurance industry

The UK government recently took the decision to legalise the use of rental electric scooters on public roads. Glyn Thompson, head of the motor sector focus team at the Forum Of Insurance Lawyers and technical lead motor at Weightmans, looks at what the…

Insurers argue FCA BI victory would lead to ‘injustice’

Defendants in the Financial Conduct Authority’s BI test case warn providers could be liable for losses they never agreed to cover.

My other life: Marco Sementa, charity fundraiser

When not working as home claims trainer at RSA, Marco Sementa uses his free time to raise money for charity playing football.

Direct Line acquires insurtech Brolly

Direct Line Group has agreed to acquire personal lines insurtech firm Brolly in a conditional transaction expected to close during the third quarter of 2020.

Car insurance premiums fall but ‘uncertainty’ dogs future pricing: WTW/Confused

While average car insurance premiums fell 5% in the second quarter of 2020, deeper analysis reveals more is going on beneath the surface as Willis Towers Watson and Confused warn of future pricing “uncertainty.”

Arch tells policyholders BI payments could be 'reduced to zero' if they wait for court judgment

Arch policyholders whose business interruption claims were confirmed to be covered by the insurer have been told that their payments could be “reduced to zero” depending on the outcome of the Financial Conduct Authority's test case.

Joint liquidators appointed for Gefion

Søren Aamann Jensen from the Danish law firm Kromann Reumert and Troels Askerud from Gefion have been appointed as joint liquidators of Gefion Insurance.

Andrew Tunnicliffe returns to Aon as UK chairman for global and specialty

Andrew Tunnicliffe has rejoined Aon in the newly created role of UK chairman, global and specialty, part of its commercial risk solutions, health solutions and affinity business.

Sam White launches Australian MGA Stella with £80m target

Pukka-owner Freedom Services Group has teamed up with private equity firm Envest and others to launch Stella Insurance, a digital managing general agent providing female-centric motor insurance in Australia.

Ifed head highlights Covid-19 impact on fraud investigations

The recently appointed head of the Insurance Fraud Enforcement Department, Edelle Michaels, told Post insurers need to be more "joined-up" in the campaign to identify suspects and protect victims.

Briefing: Ecclesiastical’s child abuse claims shame – CEO Hews’ admission too little too late?

If Ecclesiastical CEO Mark Hews is sorry for how the insurer has handled non-recent child sexual abuse claims, should he not be addressing the victims rather than shareholders?