QBE Insurance Group

The future of insurance fraud

While fraud practices have evolved over the years, in more recent times insurers have been able to better detect fraud and have seen significant savings.

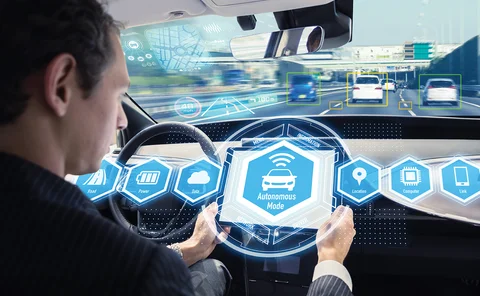

The ADAS tipping point – are motor insurers ready as the technology finally goes mainstream?

Advanced driver assistance systems have been part of new vehicles for over a decade now, with these features becoming increasingly common as manufacturers look to gain competitive advantages over rivals.

Analysis: Tackling the Covid-19 business interruption surge

Insurers have paid out final settlements or interim payments on more than 20,000 business interruption claims related to the Supreme Court's January verdict, with Financial Conduct Authority figures and broker testimony suggesting that payout processing…

Upcoming webinar: The future of insurance fraud

Post in association with Shift Technology will host a live webinar on 23 June where an expert panel will discuss how the insurance industry is adapting to changes in fraud and what we can learn from the past to inform the future.

Briefing: Time for Lloyd’s to take the lead on climate change

Climate protesters are becoming a frequent irritation for Lloyd's but, as Pamela Kokoszka explains, they are a piece of a bigger puzzle that the corporation needs to do better to acknowledge and play its part in.

ABI aims to kickstart 'revolution' with flexible working charter

The Association of British Insurers has launched a charter that will commit its 27 initial signatories to advertising a majority of roles as part-time or open to flexible working or job sharing within a year.

Zurich, QBE and Markerstudy discuss new whiplash portal on Post webinar

With just over a month to go until the new whiplash portal goes live, Insurance Post recently hosted a webinar to discuss how insurers are preparing for the change.

Analysis: The Scottish redress Bill's waiver conundrum

Scotland's redress Bill was passed by the Scottish parliament in March and sets out a fresh way for residential care abuse survivors to access compensation. But attempts to involve insurers and encourage organisations to contribute have left it with a…

Northern Ireland aims for minus 1.75% discount rate by end of May

The Northern Irish Department of Justice intends to push its minus 1.75% personal injury discount rate change through by the end of May.

Insurer results directory 2020

Updated: Post tracks the 2020 insurer results season including gross written premium and combined operating ratio - detailing the impact of UK business interruption, weather, motor, home, non-business interruption Covid-19 claims, as well as mergers and…

QBE promotes Cécile Fresneau to run insurance division

Cécile Fresneau will take the helm of QBE European Operations’ insurance division, overseeing the business in Europe and international markets in addition to the UK, from the start of next month.

Andrew Horton to exit Beazley for QBE group CEO role

Andrew Horton is stepping down as Beazley CEO handing over to Adrian Cox ahead of becoming group CEO of QBE Insurance, the two insurers have confirmed.

Spotlight: Sustainability - Driving down carbon emissions in the construction industry

In 2021, the conversation around climate change has evolved at pace. As a major contributor to carbon emissions the construction industry has a key role to play in driving down carbon emissions – could the use of timber solutions help achieve this?…

My other life: Ben McBean, open water swimmer

After getting to grips with a new hobby in the nearby River Tees during lockdown, Ben McBean, an assistant claims manager in QBE's special investigations unit, completed a marathon swim in the Lake District last summer.

UK Insurer Hot Seat 100: who has been at the top the longest?

Post has compiled a list of the 100 highest profile people working at the top for UK general insurers, Lloyd’s vehicles, international insurers with a UK presence, regulators, trade bodies and markets based on how long they have been in the hot seat.

Hiscox Action Group warns insurers may seek to ‘read down’ BI ruling

Insurers have responded to draft declarations regarding the Supreme Court’s January business interruption ruling, with the Hiscox Action Group flagging concerns that they may seek to “read down” the judgment.

Ratings agencies see ‘meaningful debate’ between insurers and reinsurers over Covid-19 recoveries

Experts have reiterated that insurer ratings are unlikely to be hit by the outcome of the Supreme Court’s Covid-19 business interruption claims ruling but noted that there will “meaningful debate” over how much insurers can claim from their reinsurers.

Frustrated policyholders call for insurers to ‘take responsibility’ after Supreme Court rules many are due payouts

Policyholders and their representatives have called for insurers to “take responsibility” and “immediately start paying claims” in the wake of a bittersweet Supreme Court judgment on disputed coronavirus-related business interruption policies.

The Supreme Court BI test case judgment in summary

The Supreme Court has substantially found in favour of the Financial Conduct Authority in the final stage of the Covid-19 business interruption test case. Post highlights key points given among the reasons behind the ruling.

Live: Supreme Court rules largely in favour of policyholders in FCA's BI test case battle

Free content: Access market and insurance reactions to the Supreme Court ruling that dismissed appeals against a High Court judgment on insurers paying out in Covid-related disruption on business interruption insurance policies and overturned the Orient…

BI Case Notes: The FCA’s test case in numbers

Updated: On Friday 15 January the Supreme Court will return a verdict on appeals in the Financial Conduct Authority’s business interruption test case.

Supreme Court BI ruling looms

The Supreme Court will issue its ruling today in the Covid-19 business interruption legal case with up to 370,000 policyholders and their insurers awaiting the outcome.

Supreme Court to hand down BI verdict on Friday

The Supreme Court is expected to hand down its judgment in the business interruption test case appeal on Friday 15 January, the Financial Conduct Authority has confirmed.

QBE’s Jon Dye on managing emerging risks in 2021

From trade tariffs on parts and whiplash reform, through to fraud, automatic lane keeping technology and connected vehicles, there is plenty for insurers to keep an eye on this year, says Jon Dye, director of motor at QBE.