British Insurance Brokers’ Association (Biba)

Ferma 2011: Ferma aims to get transparency disclosure into IMD

The Federation of European Risk Management Associations has said it will continue its fight for broker transparency and aims to convince the European Commission to include it in the next version of the Insurance Mediation Directive.

FSCS funding back under the spotlight

The Financial Services Authority is restarting its review into the funding of the Financial Services Compensation Scheme.

Staddon resurfaces at Devitt

Former British Insurance Brokers Association head of technical services Peter Staddon has joined Devitt as broker personal lines executive director.

Loss adjusters criticised by brokers for cost-cutting measures

Brokers have hit out at loss adjusters for desktopping claims and using inexperienced staff to cut costs.

News analysis: Insurance industry feels the shockwaves of the economic meltdown

It has been hard to escape the doom and gloom of the volatile stock market and wider economic woes over the past week.

Online this week

The top ten stories from www.postonline.co.uk

Market moves: All change at the trade bodies

With insurer moves slower than last week, this week has seen a number of changes among the trade bodies, with the Chartered Institute of Loss Adjusters, the |British Insurance Brokers’ Association and Federation of European Risk Management Associations…

My best 11 - David Williams, Axa Commercial Lines

Axa Commercial claims and underwriting chief David Williams picks his best XI for a potential insurance start-up company. Relying on his vast management experience Williams has selected a mix of sporting, celebrity and insurance personalities.

MGAA launch: Changing perceptions

Delayed since 2010, the Managing General Agents Association launched this month, with a brief to ensure the insurance industry and regulators understand exactly what role MGAs perform.

Biba names Homer as chairman

The British Insurance Brokers’ Association has announced that Andy Homer will become chairman of the trade association in January 2012.

Biba appoints new LMRC chairman

The British Insurance Brokers’ Association has appointed Tim Coles, chief executive of Howden Broking Group as the new chairman of its London Market Region Committee with immediate effect.

Industry associations back Government regulation reform

Insurance and broker associations have welcomed the Government’s proposed regulatory reforms in their consultation responses. However, they have also expressed concern its plans could be too “ambitious” and potentially cause delays.

Social media: Hashing out hashtags

Has the insurance industry finally mastered the art of social networking?

Industry bodies express concerns over new regulator plan

Insurance and broker associations have welcomed the Government’s proposed regulatory reforms in their consultation responses. However, they have also expressed concern its plans could be too “ambitious”, which may potentially cause delays.

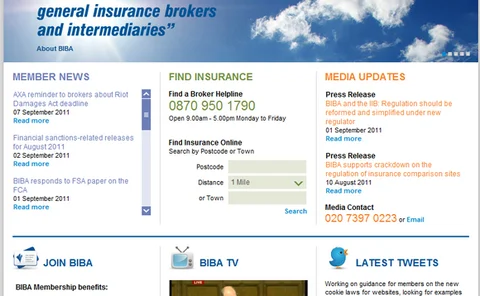

Biba relaunches website for members

The British Insurance Brokers’ Association has relaunched its website with more guidance for members and a new ‘Find a Broker’ search to promote insurance brokers to customers.

Biba calls for riot notification changes

The British Insurance Brokers’ Association has urged the government to change the Riot Damages Act notification period permanently from 14 to 42 days.

Biba and IIB call for FCA changes

The two broker bodies, Biba and the IIB, have jointly called for regulatory barriers to be lowered and for the current inappropriate style and intensity of regulation to be reformed.

Biba and government join forces over flood risk

The British Insurance Brokers’ Association is working with the government to ensure people in high-risk flood areas can still obtain insurance once the Association of British Insurers’ statement of principles expires.

Brokers call for trade credit qualification

Brokers are asking for an industry-approved trade credit qualification so they can work with underwriters to help small businesses in the face of a potential double-dip recession.

Insurers extend riot notification period

Insurers have extended their claims notification periods for claims resulting from the riots in response to the government’s own extension of the notification period under the Riot (Damages) Act compensation scheme.

OFT clears Google of monopoly rule breaches

One of the UK’s largest aggregators has welcomed the Office of Fair Trading’s decision to clear Google of any monopoly rule breaches following its acquisition of Beat That Quote. Compare The Market said the merger creates “healthy competition”.

Airmic launches riots claims resource

Commercial insurance buyers group Airmic has compiled a list of expert resources for firms making riot-damage claims and says it will update with new advice as it arrives.

Industry welcomes riot claims period extension

The insurance industry has welcomed the Prime Minister's decision to agree to extend the period for policyholders to lodge claims from 14 to 42 days under the Riot Damages Act.

Interview - Keith Stern: Raising the regional profile of Lloyd's

Tasked with rejuvenating Lloyd’s in the UK, as others look to international expansion, Keith Stern talks to Leigh Jackson about raising its regional profile and how he plans to overcome some common misconceptions.