Analysis: Motor insurers report up to 50% reduction in claims due to coronavirus lockdown

It is now just over a week since the Prime Minister locked down the UK on 23 March to help slow down the coronavirus pandemic, strict measures which have seen traffic significantly reduced on the UK’s roads. Post content director Jonathan Swift spoke to a number of major insurers to see the impact on claims, how they are managing repairs and breakdown recovery, and what fears they have over an uptick in fraud.

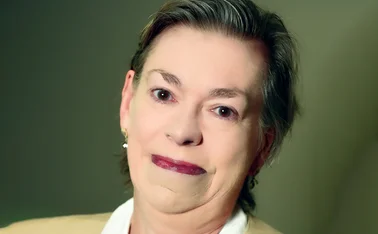

What are you seeing in terms of motor claims numbers over recent weeks?AA head of roads policy Jack Cousens: Claims are reducing as traffic volumes have fallen, but we are still receiving new cases

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk