Analysis: The future of pricing - Tightening the noose

The dual pricing noose is slowly tightening around the insurance industry’s neck. Its laudable attempts to escape from the regulatory hangman seem increasingly futile as the pressure is mounting on the Financial Conduct Authority to take action

The issues are well known and are by no means confined to the insurance industry. Consumers – and the organisations that claim to represent them – are increasingly angry at the heavy discounting customers enjoy in the first year of switching their business and the “loyalty penalty” they suffer if they do not shop around every year. This lay behind the Citizens Advice super complaint to the Competition and Markets Authority last September, which fingered five markets – home insurance, mobile phones, broadband, mortgages and savings. It attached a £4.1bn annual price tag to the loyalty penalty (see box one, p28).

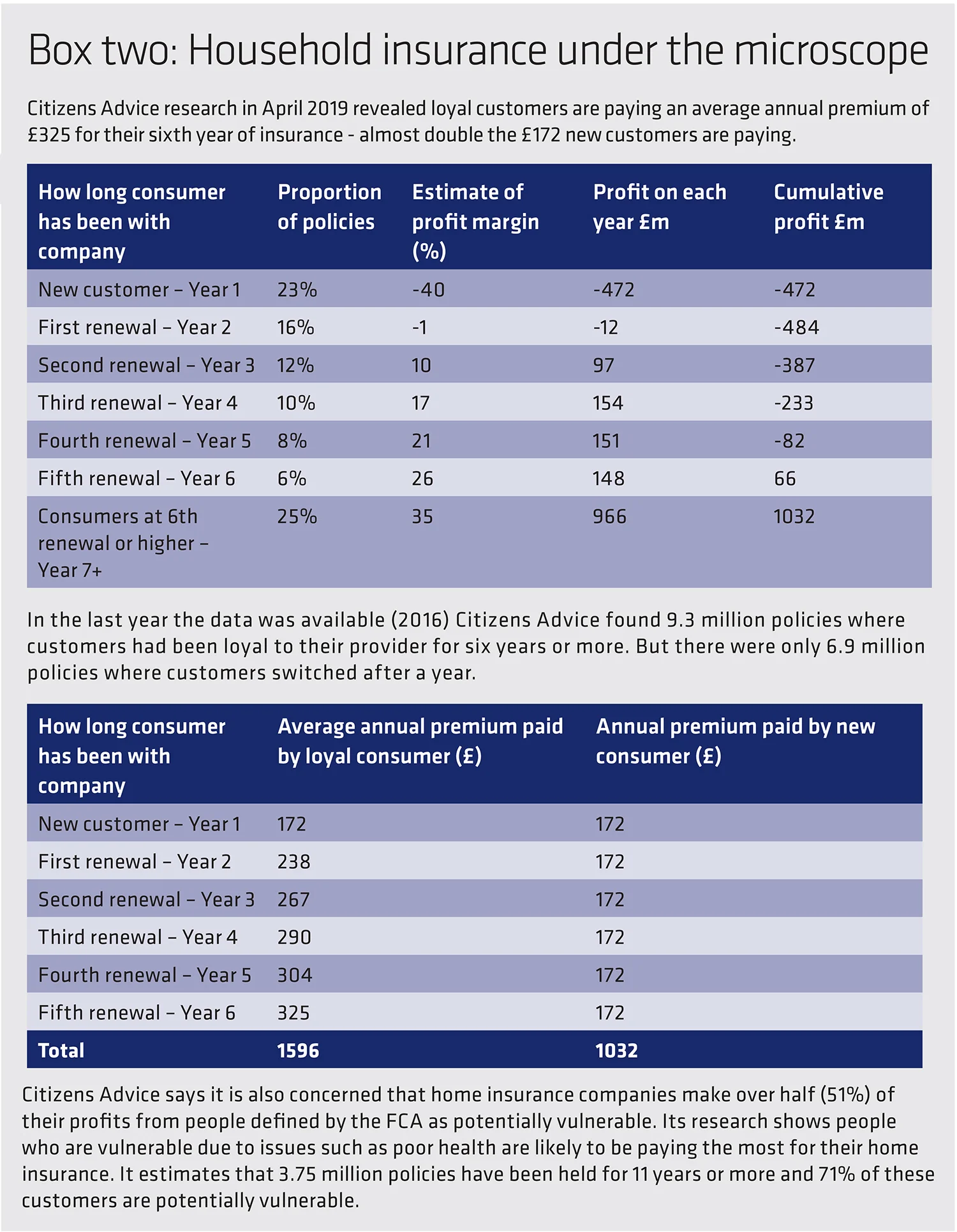

It followed that up in April this year with some detailed research on the home insurance market, which found that household insurers make all of their profits of around £1bn a year from customers who have held policies with one company for six years or more (see box two, p29).

Home insurance has been the focus up to now but the CMA has made it clear that it wants to look beyond household insurance, identifying motor, breakdown and health insurance as other areas of concern.

As the six month deadline for a detailed response to the Citizens Advice super complaint approached in mid-June, it was the government which seized the initiative and responded in robust terms which a Citizens Advice spokesperson described as a “surprise but very welcome announcement”.

Business secretary Greg Clark wrote to the CMA outlining the government’s determination to tackle dual pricing, including new powers to fine transgressors.

This was backed up by a statement from out-going Prime Minister Theresa May who said: “For far too long, many big companies have been getting away with harmful trading practices that lead to poor services and confusion among customers who have parted with their hard-earned cash.

“The system as it stands not only lets consumers down but it also lets down the vast majority of businesses who play by the rules.

“It is high time this came to an end and today we are confirming our intention to give much stronger powers to the CMA, to strengthen the sanctions available and to give customers the protection they deserve against firms that want to rip them off,” said May.

White Paper

Clark’s letter promised a White Paper containing the proposals for tough new powers: “The government has already committed to legislate in order to give consumer enforcers the power to impose fines on companies for breaches of consumer law by applying to the courts. We will follow this through and also want to go further to ensure that enforcers have the powers they need to provide incentives to firms to comply with the law.

“This will include empowering the CMA to decide itself whether consumer protection law has been broken and then impose fines for wrongdoing directly,” said Clark.

Box one: Tackling the loyalty penalty

Research in 2018 by Citizens Advice found that across five markets (home insurance, mobile, broadband, mortgages and savings):

- British consumers lose £4.1bn a year to the loyalty penalty (or £11m a day).

- Eight in 10 people are paying a significantly higher price, in at least one of the markets.

- The loyalty penalty across the five markets is, on average, £877 per year.

Following the recent government intervention, it is calling on the regulators to act urgently:

- Home insurance – The Financial Conduct Authority needs to consider limiting or banning ‘price-walking’ and requires companies to put vulnerable or low-income customers on the best value deal for their circumstances.

- Mortgages – The FCA should require firms to put vulnerable and low-income customers on to better value mortgage deals.

- Savings – The FCA needs to confirm their proposal to introduce a basic savings rate, which they estimate will save customers a net £300m a year.

- Mobile – Ofcom should move more quickly to end the mobile loyalty penalty by automatically putting customers onto a fairer tariff. If they don’t, the government should legislate.

- Broadband – Some loyal customers on standard deals are paying more than new customers for superfast broadband. Ofcom must ensure that firms are making sure their customers are on the best deals and ensure vulnerable customers are on the best deals for their circumstances.

In welcoming this announcement, Citizens Advice turned the spotlight on the FCA and called on it to act on “price-walking” (where premiums go up every year regardless of claims of other costs) and to ensure vulnerable consumer receive the “best value” policy: “We want the FCA to consider limiting or banning price-walking because people’s prices are going up just because of their loyalty. We are particularly concerned about customers who have been loyal for a long time - our research found that seven in 10 customers who’d held a policy for over 10 years were potentially vulnerable, and paying some of the worst value premiums as a result.”

Insurers and brokers have known that dual pricing has been in the firing line and have been trying to run ahead of the debate, and especially of regulatory action, says Stephen Jones, lead UK property and casualty consulting partner at Willis Towers Watson: “The insurance industry has put a lot of time and effort into addressing this and can evidence that what they are doing complies with the fairness and vulnerability agendas.”

The Association of British Insurers and the British Insurance Brokers’ Association launched a set of Guiding Principles and Action Points in May 2018, which appealed to their members to set targets to ensure that price differentiation is not “excessive” and to review the pricing of policies of customers that have been with them for more than five years.

Nervous of competition law, the ABI and BIBA are quick to point out that they cannot enforce these guidelines but have promised to review how they are working in May 2020.

But it seems as if the collective and individual responses are making little impression on the wider debate and those campaigning for action.

Sense of irritation

There is a sense of irritation at the ABI that the insurance industry keeps being lumped in with other sectors it believes are slower to act: “We have tried to address it as head-on as we can,” said a spokesman. “It is no different to what happens in other highly competitive markets. However, we want all customers to get the best deal for them and that is why we have taken the initiative.”

In the meantime, the FCA launched its own market study on pricing at the end of last year on which it has been consulting. A report is promised later this year but a few major insurers have responded with product initiatives.

Aviva Plus contains a renewal price guarantee, where it guarantees that a policyholder will not pay more than if they were a new customer to Aviva Plus, although the company will not say if and when this approach will be rolled out over a wider range of policies. Another approach is offered by RSA’s More Than, which has launched a new cashback scheme to help loyal customers offset the cost of renewing their insurance.

Premium guarantees

Saga has launched a home insurance product that guarantees the same premium for three years providing there are no claims, a sort of advance no claims discount but something that was carefully researched before launching, says Alex Cross, product and proposition director at Saga.

“It really came about through customer insight. We went out and did a lot of research among our customers and found they were often confused about why prices went up.”

Like the ABI, he was keen to stress they were looking into this ahead of the super complaint and the FCA market study: “It pre-dated the market study but it does reach a lot of the objectives the FCA has set for the industry.”

Cross urged regulators not to be too brutal in stifling consumer choice: “It came out in our research that there are cohorts of customers who enjoy shopping around and we felt we shouldn’t exclude them. They can receive some amazing pricing, often below the wholesale rate.” He urged regulators to look at alternatives to price controls: “There may be something around bringing in greater transparency over discounted pricing. We don’t fear transparency. Our whole proposition is about being transparent around cover and pricing.”

This includes being honest with policyholders on the price guarantee plan when they make a claim, telling them their premiums will increase. He said that although the pricing assumption is that there will not be a claim during the three year period not all claims would prompt an increase, citing windscreen claims as an example.

The Saga plan is probably the nearest to the sort of action Citizens Advice expects but it is still frustrated at the limited progress, said its spokesperson: “We welcome insurers offering new products that do not punish loyalty by steadily increasing premiums over time. However, the market isn’t moving fast enough on its own – that’s why the FCA needs to step in and intervene.”

The ABI says it will oppose regulation of prices: “There is always going to be talk of potential price caps but it is not clear how that could work. We want the FCA to take into account that the industry is being pro-active on this issue,” said a spokesman.

Charles Portsmouth, director at BDO, warned that price-capping could hit industry profits: “Firms have to have a realistically low premium to attract business but need to know how they are going to drive people through to the levels in later years that are likely to be profitable without penalising loyalty.

The response from the market shows that people are concerned and know they need to react. The big question will be whether the regulator thinks they have gone far enough.”

Going all the way and equalising prices could have a significant impact on premiums. A recent report from JP Morgan warned that average home insurance premiums could rise by 22% for new customers if the FCA insisted on full price harmonisation.

Others have been pushing on-demand insurance as a potential solution, especially for motor, but this is likely to have limited appeal says Jones: “I’m not sure many consumers want on-demand policies. They are administratively complex and can lead to uncertainty about whether you are covered.” In addition, the pricing model could be very complex: “Transparency does not necessarily equal simplicity.”

Toughest debate

Some of the toughest debate is likely to centre on vulnerable customers with Citizens Advice making this a priority.

“Firms should be treating customers fairly and acting in their interests, particularly for vulnerable customers. Rather than a one-size-fits-all approach, firms should be considering it their proactive duty to make sure vulnerable customers are on the best deal for their circumstances. A good starting point is having confidence that they aren’t charging their vulnerable customers a loyalty penalty,” said the Citizens Advice spokesperson.

The industry is listening, says Jones: “Internally, many insurers see this as the number one issue in terms of governance and privacy policies. It will be a challenge to meet the best value requirement. It requires interpretation and the insurer knowing a lot about its customers. With big data and analytics insurers can start to form a view on the type of cover that suits the individual customer. That might not always be the cheapest.”

The urgency of addressing these issues is clear but Cross warned that if the industry does not respond it should expect tough action: “The FCA will try to do everything it can to stop becoming a price regulator but if the market doesn’t move enough it will feel it has to go in that direction”.

Fines, price-caps, greater transparency are all woven into the regulatory noose that could soon be placed around the industry’s neck.

Further reading

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk