News

UK develops secure AI guidelines

The UK has published guidelines to ensure the secure development of artificial intelligence technology.

Allianz makes changes to leasehold products following FCA reforms

Allianz has issued an email to its brokers outlining changes to its multi-occupancy buildings insurance products, which includes capping commission at 30%.

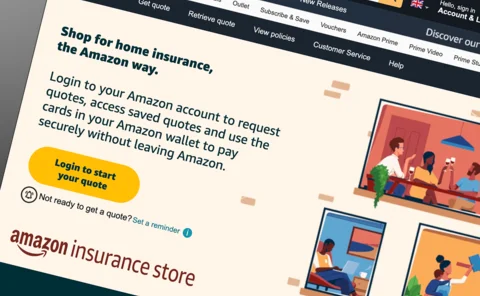

Amazon adds fifth provider to Insurance Store

Amazon has signed-up Urban Jungle to its Insurance Store, making it the fifth insurance provider on the tech-giant’s platform.

Lloyd’s consults on Net-Zero approach

Lloyd’s of London has launched a consultation among member firms on its proposed approach in insuring the low-carbon transition over the next three years.

Big Interview: ManyPets’ UK CEO Luisa Barile and co-founder Steven Mendel

Following a difficult period where ManyPets pulled out of the Swedish market and paused sales in the US, newly appointed UK CEO Luisa Barile and co-founder Steven Mendel sat down with Scott McGee to talk through the provider's plan to get the UK business…

Gove brings Bill banning excessive commission to parliament

Michael Gove, Secretary of State for Levelling Up, has brought a Bill to give leaseholders more power, while banning opaque and excessive buildings insurance commissions for freeholders and managing agents.

Axa’s bodycams; Pen’s box at Lloyd’s; Utility Warehouse’s CEO steps down

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Insurers urged to back more British environmental reinstatement projects

As biodiversity loss reaches an all-time high, insurers are being asked to consider reallocating funds to help ‘direct action’ projects in the UK to support the country’s depleted ecology.

Hackers issue Sabre with ransom demand following cyber attack

The hacking group behind Sabre’s cyber attack last week has issued the insurer with a ransom demand and given a deadline for which to respond.

Sabre suffers cyber attack

Sabre has today revealed it was subject to a cyber attack last week, however it believes no sensitive data was accessed.

Tokio Marine reveals risks faced by London

London’s future is threatened by more extreme flooding and failure to keep pace with technology, according to a new study, with Tokio Marine arguing insurers should help the city prepare for cybersecurity and artificial intelligence developments.

Covéa’s Callan appointed retail MD for Brown & Brown

Brown & Brown has appointed Callan as managing director of its Retail Division. Callan previously served as Commercial Lines Director at Covéa before leaving in July.

AssuredPartners’ double swoop; LMA and Liiba’s collab; Pen’s IP proposition

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Hiscox on the limitations of AI technology

Regulations, accuracy and ensuring humans are kept accountable are some of considerations insurers have been warned to factor in to ensure success with artificial intelligence.

Armilla to tackle AI screw-ups with warranty product

Insurtech start-up Armilla AI has launched an AI product warranty to give companies protection and peace of mind against the risk of issues with the technology.

Five key takeaways from Post's AI roundtable

Insurance Post recently gathered together a group of insurance technology experts to discuss the rapid rise of artificial intelligence and how insurers need to position themselves to respond to the changing business landscape. Frances Stebbing recounts…

ManyPets completes flurry of executive hires as CEO Eleazu departs

ManyPets has a new line-up for its UK executive team, as CEO Oke Eleazu announces he is to leave the business, Insurance Post can reveal.

Verisk on testing generative AI platforms

Chris Sawford, Verisk's managing director of claims for the UK, discusses what makes an artificial intelligence trial successful and how the technology helps insurers achieve operational efficiency.

Kennedys IQ on using AI for ‘highly complex’ claims

Karim Derrick, chief products officer at Kennedys IQ, shares how the company is using artificial intelligence for complex claims documents.

IFB reveals how AI has sped up detection of fraudulent claims

One year on from launching its AI counter-fraud solution, the Insurance Fraud Bureau has revealed how the tool has “elevated” the sector's fight against fraud.

Standalone R&Q legacy business to target profitability by 2025

A “refocused” R&Q legacy insurance business will expect to deliver operating profitability by the end of 2025 if the proposed sale of the company’s programme management arm Accredited goes ahead.

Environmental threats slip down agenda as top UK risks are revealed

Economic and societal concerns have overtaken environmental risks as global business leaders share their biggest concerns in the World Economic Forum’s executive survey.

Principal on how AI is spotting vulnerable customers

Principal Insurance has revealed how it has deployed Xdroid’s artificial intelligence powered solution to report on all speech, email and chat interactions to improve customer outcomes.

How AI is transforming Aurora’s underwriting

Bijal Patel, co-founder of Aurora, explains how the MGA is leading the way in taking a data science approach to underwriting and what skills insurers need to develop.