Swiss Re

Guest blog: Market cycles, cost of reinsurance and the Middle East

In the course of the year, concerns over the rising cost of regulation with impending Solvency II have been heard, even by Ferma’s Peter Von Dekker, as a cost that is ultimately likely to be absorbed by consumers.

Editor's comment: Impacting the market

Market-turning they may not be but market-impacting they evidently are. Revised loss estimates for the 1500 industrial units hit by the Thai floods have reached $20bn.

News analysis: Escalating loss estimates in Thailand begin to trigger market fallout

It was the worst flooding Thailand had seen for 50 years and, during its four-month spell, more than 600 people died and 77 provinces were submerged in water.

Product innovation in European insurance firms is widespread

Product innovation in non-life insurance is widespread according to a new report.

Swiss Re estimates Thai losses at $600m

Swiss Re estimates its claims costs from the flooding of 1500 industrial units in Thailand to be $600m, net of retrocession and before tax.

Emerging markets look set to grow in 2012

Despite growth slowing in 2011 emerging markets will remain “reliable growth engines” in the global insurance markets in 2012, according to reinsurer Swiss Re.

Haircut on bonds could be absorbed by European insurers

A 50% haircut on Greek, Irish and Portuguese sovereign bonds could be absorbed into European insurers’ existing capital resources, according to Swiss Re’s senior economist.

Swiss Re warns of low profits for 2012

Swiss Re’s economists say the insurance industry will not pick up until after 2012.

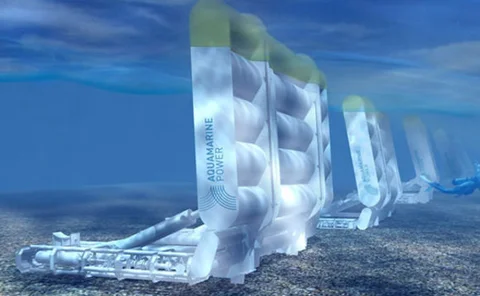

Insurance key to encouraging private investment into renewables

Significant financial risk is most acute hazard for renewable energy sector, according to a report by Economist Intelligence Unit and Swiss Re.

Swiss Re announces delisting of outstanding shares

Swiss Re has announced the delisting and squeeze out of outstanding shares in Swiss Reinsurance Company Ltd.

News analysis: Admiral’s claims woes worsen as quarter three results revealed

Admiral’s market followers suffered a painful dose of déjà vu last week when the motor insurer’s quarter three results underscored its rising exposure to large bodily injury claims, and it warned full year pre-tax profits would be lower than expected.

Admiral share price rests on analyst presentation

Admiral’s analyst presentation this afternoon could see its share price rise if it “hits the market with new stuff” or plummet further if it fails, experts have warned.

Swiss Re buys $130m cat bond for Atlantic hurricane and European windstorm

Swiss Re has obtained a further $130m in protection through the Successor X catastrophe bond programme for North Atlantic hurricane and European windstorm.

Swiss Re makes $130m in natural catastrophe protection

Swiss Re has obtained a further US$ 130m in protection through the Successor X catastrophe bond programme covering North Atlantic hurricane and European windstorm.

The challenge of life sciences

Mid-sized life sciences firms offer an attractive opportunity for insurers in Europe with many entering the market. Yet as Francesca Nyman reports litigation and legislation make this a challenging market too.

Financial market volatility hits Swiss Re’s core combined ratio

Swiss Re saw the combined ratio for its property and casualty segment increase to 80.8% for the third quarter of 2011 due largely to financial market volatility.

Swiss Re reports 118% net income rise

Swiss Re reported a 118% increase in net income in its third quarter to $1.3bn (2010 $0.6bn).

Standard & Poor upgrades Swiss Re to AA-

Standard & Poor has upgraded Swiss Re from A+ to AA- following the firm success in derisking its asset portfolio, convertible perpetual capital instrument with Berkshire Hathaway and stabilised its net income.

Swiss Re upgraded to 'AA-'

Standard & Poor's Ratings has raised its long-term counterparty credit and insurer financial strength ratings on Swiss Re and its core subsidiaries to 'AA-' from 'A+'. The outlook on all of these entities is stable.

Thailand flood losses manageable for insurers

While the current flooding in Thailand is unusually severe and economically costly, the insured losses are likely to be at a manageable level and will not trigger widespread solvency problems, or undue financial strain, for the country's non-life…

Rating factors - Age: Age-old dilemma

After losing the battle to use gender as a rating factor, could the insurance industry be facing a new threat as age falls under the spotlight?

Climate change: A changing environment

With insurers rushing to provide environmental cover, how are they performing themselves in the climate change stakes?

Swiss Re corporate aims for top 10 commercial position

Swiss Re’s new dedicated commercial arm is aiming to be a top 10 player for brokers in the corporate market.

In series - Lloyd's & London Market: Social strengths

The CII’s London market faculty New Generation Group is downbeat about Lloyd’s adoption of social media. Post spoke to its members to find out why.