AM Best affirms ratings of German insurer SOVAG

AM Best has affirmed the financial strength rating of B++ (Good) and the issuer credit rating of 'bbb' of SCHWARZMEER UND OSTSEE Versicherungs-Aktiengesellschaft SOVAG. The outlook for both ratings remains stable.

SOVAG's risk-adjusted capitalisation is expected to remain strong, despite some weakening due to recent unfavourable underwriting performance. A more stable position is anticipated in future supported by better underwriting performance and SOVAG's substantial equalisation reserves.

Rate strengthening for German motor business and a reduction in the volume of motor fleet business written in 2011 are expected to support improving underwriting performance.

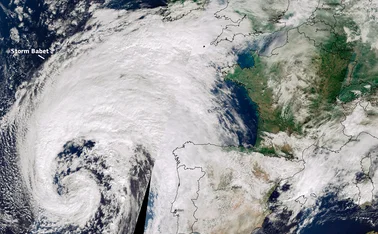

SOVAG's high combined ratio in 2010 of 122% reflects soft rates for German motor business (2010: 47% of net premiums written) as well as the impact of severe weather conditions in continental Europe.

AM Best said it does not believe SOVAG will be required to pay significant dividends to its investors, Volga Resources and Sogaz Insurance Company OJSC.

SOVAG's business profile remains good as a specialist insurer of risks emanating from Russia and the Confederation of Independent States, and as a leading provider of insurance cover for Russian immigrants in Germany.

In 2011, gross premiums written are likely to increase from E93.5m in the previous year, due to increased underwriting of property business.

AM Best believed the involvement of SOGAZ (shareholding of 45.9% acquired in December 2010) will help further develop SOVAG's business profile within the Russian market.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk