Briefing: Aon pay cuts – let’s not mistake consent for approval

Aon UK chief operating officer Nathan Shanaghy and the rest of the leadership team may have been left “humbled” by staff responses to global pay cuts, but that doesn’t mean the broker hasn’t served its workforce up a raw deal.

As per an April update from Aon CEO Greg Case to the risk giant’s 50,000-strong work force, 70% of staff at the global broker are expected to take a 20% pay cut.

Meanwhile the broker put share buyback plans on hold but committed to paying out on its upcoming dividend.

Case and a number of named execs themselves took a 50% salary cut as he pledged that no Aon jobs would be lost as a result of the pandemic.

A month ago I wrote that the dividend decision left a sour taste.

Since then, Marsh & McClennan CEO Dan Glaser’s remarks, labelling cuts “an awfully blunt instrument,” have stirred the pot.

Soon-to-be merger partner Willis Towers Watson CEO John Haley has said he has no current intentions to follow Aon’s lead.

However, the narrative from Aon has been that staff have overwhelmingly accepted – in Case’s own words “embraced” – the salary slashing.

But there are a couple of reasons that calls of “Aon United” feels a bit flimsy.

A big one is that Case’s salary, which will be cut in half, is a small part of his total remuneration.

Data from Salarydotcom shows that in 2018, the latest data available, Case made $16.2m.

Just $1.5m of this was through his salary, with $1.3m as a bonus and an eye-watering $12.7m through stock options.

Most of Case’s financial gain from Aon is coming through stocks. So by slashing his salary but not the dividend, the top boss will still see a tidy pay out while employees lower down the chain may find themselves struggling to make their mortgage or rent payments.

According to documents shared with staff and obtained by Post, Aon UK’s threshold for cuts is £40,000. This is not an astronomical figure, particularly for staff living and working around London or supporting a family.

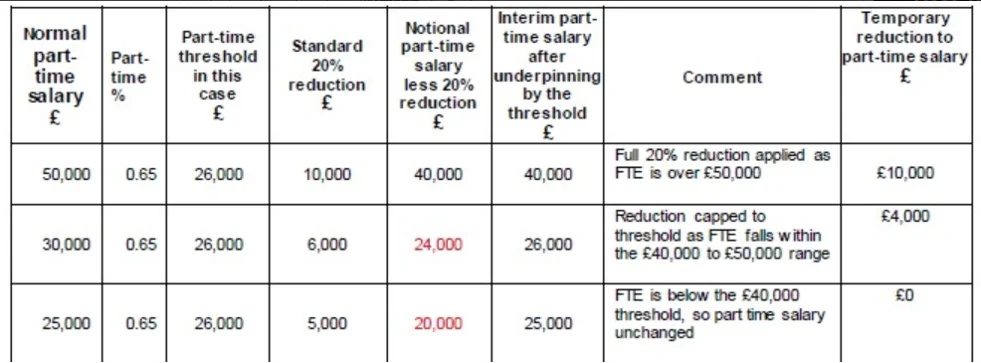

And while the lower threshold is £40,000, this is calculated on a pro-rata basis so part-timers will also be hit.

For example, if someone works 65% of full-time hours, the cutoff point becomes £26,000 (see table from Aon UK internal documents to staff).

In 2016 PWC identified a £1bn career break penalty for women returning to work. One solution the insurance industry has been pushing has included more flexible-working and part-time opportunities.

With part-timers also facing wage cuts, there is a very real risk that diversity and inclusion efforts will be hampered and staff who aren’t able to put in full time hours because of other commitments or needs could suffer the most.

In an email to Aon’s UK workforce, dated 28 May, UK chief operating officer Nathan Shanaghy said: “We would like to thank those of you who have joined your colleagues around the world in agreeing to take a temporary salary reduction. Nearly all of those asked have found ways to accommodate this huge ask and have consented to the temporary reduction. We recognise how big of a commitment this was for you and the UK leadership team is incredibly humbled, grateful and proud of your response, which will help protect jobs across Aon.”

But what Shanaghy and the top team at Aon are not acknowledging is that sometimes, when the only other option on the table is unthinkable, consent doesn’t feel like commitment. And it doesn’t equate to approval.

It would be a lie to say that some employees have not been vocal about supporting Aon’s strategy. But according to sources at the broker, many also feel let down and betrayed. Some believe it has put shareholders and ratings before staff at a time when the world is already facing a social, humanitarian and economic crisis.

With other global brokers failing to follow suit, to what end?

And with the mega-merger with WTW on the horizon, no job losses for now may feel like a hollow promise. You almost have to wonder: is the risk giant pushing its people away?

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk