Articles by Scott McGee

Big Interview: Clear Group CEO Mike Edgeley

Three years into his role as CEO, and 18 months on from the investment from Goldman Sachs, Clear Group CEO Mike Edgeley speaks to Scott McGee about his military background and how the broker’s growth is "not just about scale".

Is Biba right to worry about personal lines broking?

News Editor’s View: After the British Insurance Brokers' Association asked personal lines insurers to commit to the broking channel, Scott McGee looks at what has got brokers spooked, and what action needs to happen in order for a fruitful future.

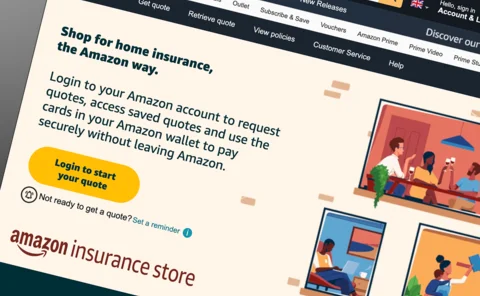

Amazon to close down Insurance Store

Just 15 months after its October 2022 launch, Insurance Post can reveal that Amazon is closing down its UK Insurance Store.

Fraud ring uncovered by Keoghs and major retailer

Following a three-year investigation, Keoghs and an unnamed major retailer have exposed and convicted a sophisticated fraud ring.

Perils updates Storm Babet damage valuation to £586m

Perils stated £467m of the losses from Storm Babet and Aline occurred in the UK and were mainly flood-related.

Auxillis owner ‘in talks to buy Kindertons’

According to multiple industry sources, conversations are being held for the potential sale of accident management and mobility company Kindertons to Redde Northgate, the parent company of Auxillis.

Bloomberg warns Admiral and DLG could suffer from FCA premium finance action

Admiral and Direct Line’s profits could be threatened if the Financial Conduct Authority clamps down on companies charging customers for paying motor insurance premiums monthly, Bloomberg Intelligence has warned.

MP highlights loophole in Leasehold Reform Bill

Matt Brewis, head of insurance for the Financial Conduct Authority, has appeared before a parliamentary committee to discuss the Leasehold and Freehold Reform Bill and been challenged by MPs over whether the current crop of rules ensure insurance costs…

Big Interview: Matt Brewis, FCA

Matt Brewis, the Financial Conduct Authority’s head of insurance, explains to Scott McGee why premium finance is a “poor product,” denies the watchdog is Miss Trunchbull-like, plus shares the regulator's plans for 2024.

Biba hedges political bets with manifesto

The British Insurance Brokers’ Association has released its manifesto for 2024, which CEO Graeme Trudgill says will “resonate with all political parties”.

FCA confirms further AR restrictions

Having previously placed restrictions on four insurance brokers feared to be failing to ensure appointed representatives comply with the regulator’s rules, the Financial Conduct Authority has confirmed three more sanctions.

ABI still 40% short of capacity for fire safety scheme

The Association of British Insurers’ Fire Safety Reinsurance Scheme, designed by McGill and Partners, is still some way off launching, despite numerous claims it would be ready by the end of summer 2023.

FCA to clamp down on premium finance outliers in 2024

Briefing: The Financial Conduct Authority’s head of insurance Matt Brewis has labelled premium finance a “poor product”, and warned the regulator has “talked about it enough,” hinting at potential action surrounding the practice in the next 12 months.

Q&A: Morgan Lyons, Zurich

Months into his new role as Zurich’s head of mid-market, Morgan Lyons sits down with Scott McGee to talk about challenges within the mid-corp market, improving broker service levels, and attracting and retaining talent.

Vandals continue to target heritage buildings

Nine out of 10 heritage organisations have experienced crime within the space of 12 months, according to research commissioned by Ecclesiastical.

Regulator reviewing R&Q before Accredited sale

The Bermuda Monetary Authority has requested an independent actuarial review of the required reserves of the remaining R&Q Group following the proposed sale of Accredited.

Fully autonomous cars on the road by 2026, claims Transport Secretary

With the Automated Vehicle Bill currently making its way through parliament, Transport Secretary Mark Harper has said vehicles “that have full self-driving capabilities” could be rolled out as early as 2026.

Scope of Luton Airport damage revealed as salvage mission confirmed

Insurance Post can reveal that Copart has been appointed the lead salvage agent for the Luton Airport fire operations when demolition of the car park commences.

Copart CEO hits back at Competitions Authority

Copart’s UK CEO Jane Pocock has hit back at the fines issued to the salvage firm from the Competitions and Market’s Authority.

Opportunistic fraud claims on the increase in 2023

Sedgwick has reported an increase in low-value and opportunistic claims fraud in 2023.

Copart fined £2.5m by Competitions Authority

Copart has been fined £2.5m by the Competition and Markets Authority for failing to comply with an enforcement order on three occasions.

Storm Ciarán spares UK insurers with losses pegged at £1.63bn

Perils has estimated the full losses of Storm Ciarán, which hit the UK and mainland Europe in November this year, at €1.9bn (£1.63bn).

Admiral reveals plan to grow home and pet books after RSA deal

Following the £115m deal to buy RSA’s direct home and pet business, Admiral’s deputy CEO of UK insurance explains how the business intends to continue to grow these lines.

Questions remain as more brokers sign leasehold pledge

Seven more broking firms have signed up to the leasehold commission pledge in association with the Department for Levelling Up, Housing and Communities.