Energy crisis fails to derail insurers from hitting ESG targets

Data analysis: Insurers and reinsurers are managing to stick to their shorter-term goals of cutting underwriting emissions even during the energy crisis.

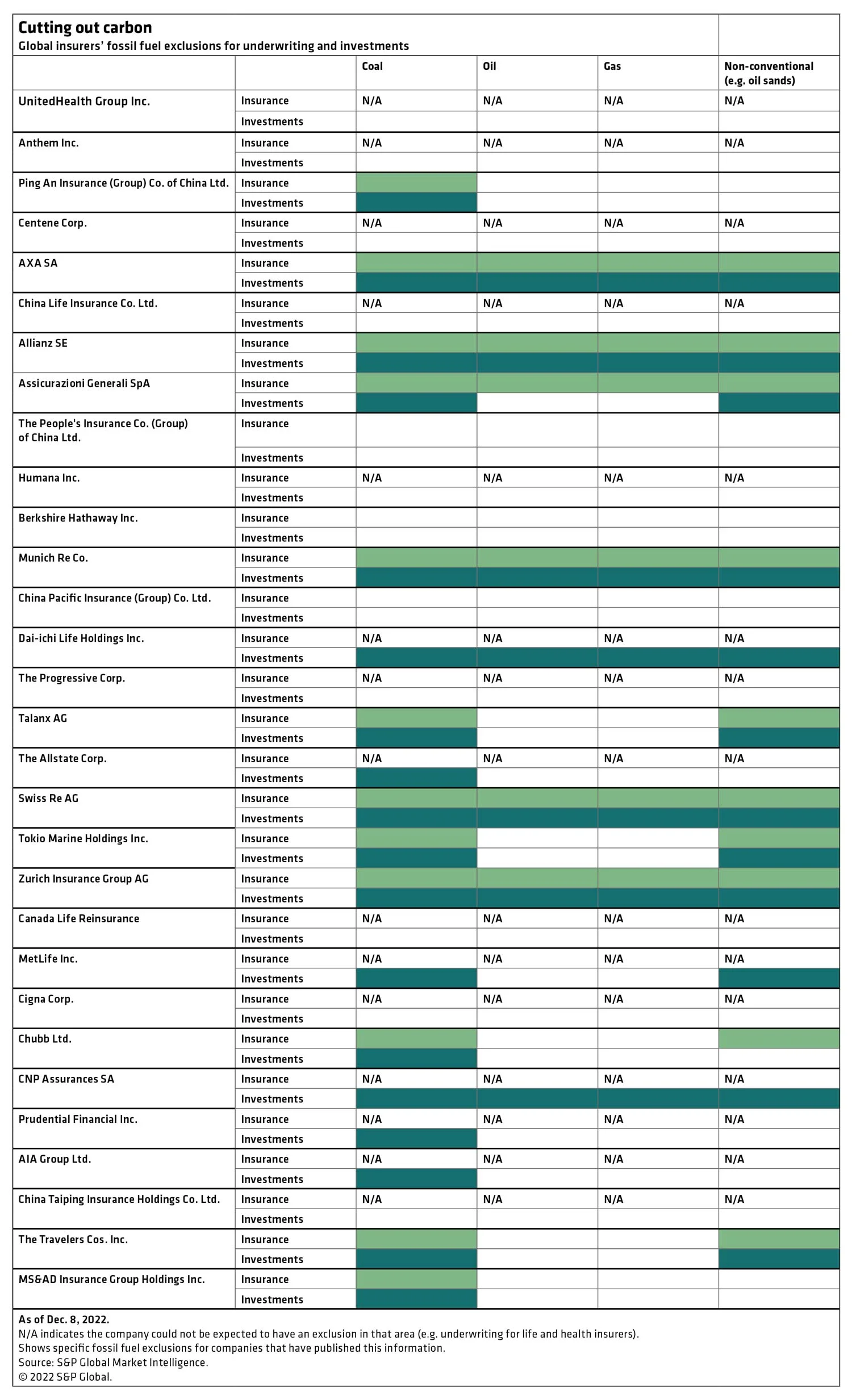

Analysis of underwriting emissions, conducted by S&P, shows despite Germany restarting coal-fired power plants and France putting a coal plant that was closed in March back online, several top insurers are not budging on either their short or longer-term net zero commitments.

Swiss Re is not planning any changes to its ESG and sustainability-related policies, including its fossil fuel underwriting thresholds and interim goals, Martin Weymann, the reinsurer’s group head of sustainability, has said.

We have made clear and strong sustainability commitments, and the group does not intend to change its path

Zurich spokesperson

The company wants to remain consistent with what it has told its own underwriters and the outside world, Weymann said, and the reinsurer has given clients and brokers "quite a bit of [lead] time" about its intentions.

Swiss Re does not offer direct and facultative reinsurance to companies or projects that have more than 30% exposure to thermal coal.

From 2023, treaty reinsurance business that exceeds certain thermal coal exposure thresholds, which are specific to each line of business, will be gradually lowered.

The company plans to exit coal underwriting completely by 2030 in Organisation for Economic Co-operation and Development countries and by 2040 in the rest of the world.

A spokesperson for Zurich told S&P the insurer also has "no plans to change our approach".

Asked how the company would respond to client and broker pressure for fossil fuel cover, the spokesperson said, "We have made clear and strong sustainability commitments, and the group does not intend to change its path."

Flexibility

S&P found providers were able to stick to their ESG targets because of the flexibility in some insurers' and reinsurers' fossil fuel exclusion policies, which should allow companies to accommodate short-term energy needs.

For example, Allianz's oil and gas policy, announced in April, contains an exception for new upstream gas fields if needed for emergency energy security reasons.

An Allianz spokesperson said in an email to S&P that the oil and gas policy was set "taking careful account of geopolitical developments" and the company would continue to monitor developments closely.

Curtailed ambitions

While the insurance industry "has to respond" to the short-term increase in demand for fossil fuels – the result of an energy crisis brought about due to Russia's invasion of Ukraine – this does not mean companies have set aside their efforts to help the transition to cleaner energy, according to Gurpreet Johal, Deloitte's global lead partner for global reinsurance and the London market.

Johal said companies were continuing to look at decarbonisation initiatives with clients and projects such as insuring hydrogen plants.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: http://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk