Motor

Contract for MOJ-driven electronic claims process reform awarded

Technology systems provider CRIF to implement electronic communications process as part of MOJ reforms

Cunningham Lindsey helps police recover £2m stolen vehicle haul

Claims company assists in six week organised crime operation

At a total loss

Total loss management can cause headaches for claims handlers and policyholders alike. David Patten reflects on customer confrontations, insurer answers and whether there is a better way.

Time bandit

With the detail out this month on the new streamlined process for settling motor personal injury claims, Amy Ellis details continuing concerns and asks just how much time and money will be saved.

UK insurer to create 550 new jobs

Fortis CEO Barry Smith confirms first raft of jobs linked to major business wins.

The Bike Insurer signs British Eurosport deal

Comparison site to become title partner to motorcycle racing events

Claims Club Annual Conference

Video interviews with leading insurance industry claims managers from last week's Claims Club Annual Conference.

Getting inside the mind of claims managers

Post recently surveyed its well-respected database of general insurance company claims managers into the motor and property sector supply chain. Anthony Gould provides a glimpse into the report's top line findings on supplier selection, monitoring,…

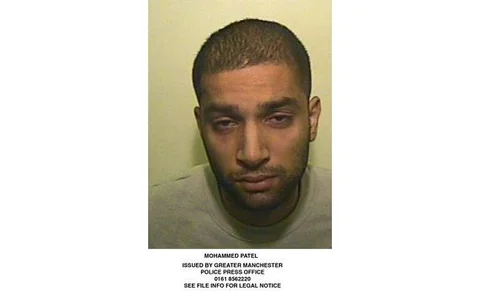

Cash for crash scam ring leader jailed for four and a half years

IFB welcome sentancing of Mohammed Patel.

Thatcham strengthens ties with Korea

Motor research centre forms agreement with Korean institute

Admiral turnover up 22% to £294m

Henry Engelhardt: "not much has changed"

Getting the message across

The rise in uninsured driving in the UK looks set to increase as the recession takes hold. Veronica Cowan reports that insurers now realise this challenge must be faced head-on.

Carole Nash expands motor offering

Move into military vehicles and motorhomes

Shene to outsource claims to Bankstone

Personal lines broker appoints claims specialists for motor, household and business

Unfinished business

Entrepreneurial players in the claims market have benefited from maximising the incentives of motor injury claims in recent years, but the trend towards commoditisation of claims handling does have its place, writes Alistair Kinley.

Cashing in on crashes

Sarah Adams reports on 'crash for cash' scams and how geographic data can help prevent fraud in this area.

Cutting edge

The crackdown on 'crash for cash' scams by insurers has reaped rewards. Ana Paula Nacif reports on the need for the industry to step up a gear and keep on the cutting edge of the fight against fraud.

BGL on recruitment drive

50 posts to fill as e-commerce business thrives