Insurer

Insurance Hound: Most read by insurers in April and May 2021

Which topics have insurers been reading most about?

Kessler 'can't hold shareholders hostage this time', says Ciam as it calls for Scor chairman's removal

Investment fund Ciam is encouraging shareholders of Scor to vote against the reelection of chairman and CEO Denis Kessler and two other directors to the reinsurer’s board.

Wefox could have raised $1bn say co-founders

Insurtech Wefox could have raised over $1bn (£706m) but chose to close its series C funding round at $650m, its co-founders told Post.

Cross-sector working group seeks clarity on mixed injury whiplash portal claims

A cross-sector working group has been set up with mixed injury whiplash test cases set to make their way through the courts.

Insurers failing on ESG: report

Insurers are failing to tackle ESG issues, a report by Share Action has warned, though European businesses are at the front of the pack.

RSA sale to Intact and Tryg completes

RSA has been bought by Canadian insurer Intact and Danish provider Tryg as scheduled for £7.2bn in cash with CEO Stephen Hester departing.

Hiscox’s Tim Slattery on fast changing customer lifestyles demanding an agile response

Tim Slattery, personal lines underwriting manager for Hiscox UK, argues the industry needs to both listen to what home policyholders need now and have the forethought to provide what customers don’t yet know they’ll need.

FCA price walking ban to go live in January

The Financial Conduct Authority has confirmed that its ban on price walking, intended to eliminate the so-called ‘loyalty penalty’, will come into effect on 1 January 2022.

French regulator sees no evidence of Scor share price abuse

The Authorité Des Marchés Finances has been unable to substantiate price manipulation allegations made by Covéa against Scor.

Industry keen for stability to follow management merry-go-round

Experts have urged Allianz and Aviva to keep a stable focus on the independent regional broker market as the insurers unveiled a merry-go-round of leadership changes.

Briefing: Lemonade’s phrenology hangover

Jen Frost reflects on a staggering self-engineered series of events that saw insurtech Lemonade have to deny using outdated and disproven phrenology in its artificial intelligence claims system.

Google lays out scam advert counter measures

Google has detailed the steps it is taking to protect consumers and legitimate businesses in the financial sector after research by Post revealed that brokers are being targeted by claims management companies.

Government-backed trade credit reinsurance scheme to end on 30 June

The UK trade credit reinsurance scheme will close on 30 June, the government and the Association of British Insurers have announced.

Aviva faces leaseholder ire over mounting fire safety concerns

Aviva has drawn anger from leaseholders in residential properties owned by an investment fund over the management of fire safety issues.

Analysis: The broker problem with online claims adverts

Research by Post has revealed that brokers as well as insurers are being targeted by claims management companies seeking to take over motor claims via misleading advert urls online, particularly on mobile devices

High Court gives go ahead to RSA takeover

The High Court of Justice in England and Wales has approved the takeover scheme that will lead to Intact and Tryg buying RSA.

Colm Holmes named Allianz UK CEO with Adam Winslow to step in at Aviva

Allianz Holdings CEO Jon Dye will step down in November 2021, with current Aviva CEO of general insurance Colm Holmes set to replace him and Adam Winslow to step in as UK & Ireland GI CEO at Aviva.

Aston Lark's Peter Blanc on relevance and opportunity

Aston Lark group CEO Peter Blanc assesses why the market can’t just continue to offer the same old products, tweaked to be one step ahead of the next best, with cover for intangible assets coming to the fore along with the need to have challenging…

MGA market trends to drive years of growth for independent program managers, says R&Q's Spiegel

Randall & Quilter expects its program management business to benefit from secular trends in the managing general agent market for at least the next five years, following a bumper growth year in 2020.

Briefing: Time for Lloyd’s to take the lead on climate change

Climate protesters are becoming a frequent irritation for Lloyd's but, as Pamela Kokoszka explains, they are a piece of a bigger puzzle that the corporation needs to do better to acknowledge and play its part in.

Insurtech Focus: Founders of the Future

Although cynics saw them as a fad, insurtechs are now very much part of the UK insurance scene. Indeed some have matured into sizable businesses that are proving attractive to employees who might have otherwise never though about a career in insurance…

Post LIVE Tech: Pandemic an 'impossibly hard time' for some insurtechs

While some insurtechs have shone through the pandemic, others have been faced with mammoth difficulties around changing customer priorities and restrictions, a conference heard.

Under the Bonnet, driven by Haynes Pro: The role of the vehicle insurance group rating system

In the second of a quarterly series in association with Post, Haynes Pro assesses the influence of the vehicle insurance group rating on motor premiums, and asks whether it could be on the wane as connectivity increases

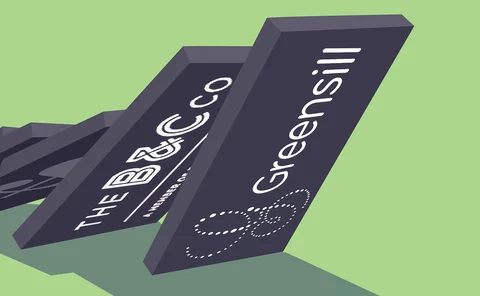

Analysis: The insurance domino that toppled Greensill

The founder of Greensill Capital pinned the blame for the finance firm's collapse on its insurers when addressing politicians last week.