Technology

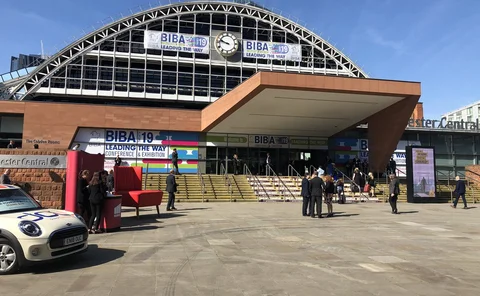

Briefing: As Covid pushes Biba 2021 online, a death knell sounds for 'in-person only' conferences

Last week the British Insurance Brokers’ Association followed others' footsteps as it moved its 2021 conference online. Post news editor Jen Frost considers the future of events.

Attend the 2020 British Insurance Awards on 17 November

The British Insurance Awards might have lost its traditional venue the Royal Albert Hall and an in-person audience this year, but it is still set to have all the pizazz, glitz and fun you’d expect from the most prestigious event in the industry calendar.

Analysis: BI claims 'avalanche' warning as loss adjusters look to tech

Loss adjusters are looking to technology to deal with business interruption claims, with the market preparing for a possible influx following the upcoming Supreme Court test case review.

Briefing: Is RSA's sale to an overseas bidder a sign of the UK’s declining stature as a global insurance player?

With RSA poised to be sold to a consortium of a Danish and Canadian investors, the number of internationally recognised UK-domiciled insurers is set to reduce by one. Post content director Jonathan Swift asks: is it time to dust off plans for the Royal…

Direct Line brands IBM’s work 'materially defective' in £36m legal fight

IBM’s work contained “extensive” and “material” issues in both design and execution that should not have been present at a late stage of development, a Direct Line Group subsidiary has alleged in an ongoing legal spat over an IT contract.

Vote now for the winner of the Industry Impact Award at the 2020 British Insurance Awards

This prestigious award recognises the importance of business deals, partnerships and key hires, and the 2020 winner will be decided by you.

Zurich to retrain 3000 UK staff over five years

Zurich’s analysis of its UK workforce has shown that the future impact of technology could mean 270 jobs go unfilled in the next five years if its team is not reskilled.

Video: Driving change in insurance and rebuilding trust in the market - both during and after the pandemic

Pre- or post Covid, insurance has been on the cusp of major change for a number of years.

Video: Insurance and Covid-19 - Initial reaction to the crisis and rebuilding in a new environment

Like all industries, insurance has been impacted profoundly by the Covid-19 pandemic.

Aon and Direct Line Group discussed how insurance firms can seize the initiative on privacy, cyber risk and operational resilience

What operational challenges have insurance companies faced and how can they ensure optimal cyber resilience for future disruptions?

Future Focus 2030: The insurance eco-systems podcast - the evolution of collaboration

It is the year 2030 and the last decade has seen the insurance eco-system evolve as quickly in 10 years as it had previously done in the last century.

Future Focus 2030: The eco-system revolution

As part of a monthly series, Post looks into the future at how the insurance industry might change, focusing on a specific issue. For this instalment David Worsfold looks into the evolution of insurance eco-systems

Minster Law posts £1.1m profit as it launches digital claims portal

Minster Law has reported a £1.1m profit for 2019 as it launches a digital claims portal to 75% of its customers.

Fully Comp episode 5: The insurance challenges of automated lane keeping systems

Welcome to the fifth episode of Fully Comp, Insurance Post’s new regular video series tackling some of the biggest issues in insurance.

Pen Underwriting’s Tom Downey on data quality and the need for collective responsibility

Tom Downey, CEO of Pen Underwriting, sets out why data quality is the key battleground of today that no-one in the insurance industry can afford to lose.

Zurich, Ecclesiastical, Ageas and Aviva discussed the future of claims management

There has been a lot of talk about how the March lockdown has acted as a trigger for insurance businesses to review processes throughout their organisation from the perspective of a ‘new normal’ – where customers and employees alike are living and…

Blog: Mexico Reef Protection Program – a nature-based solution to extreme weather risk protection

Climate and extreme weather-related shocks are increasing in their frequency and severity, endangering businesses and livelihoods in vulnerable markets. However, as these risks have augmented, so has the arsenal to combat them, considers Juan Marcano,…

Insurtech Cytora unveils £2000 travel perk as it switches to permanent home working model

Commerical insurance focused insurtech Cytora has moved to a remote-first set-up for employees including a £2000 annual budget for each member of staff to spend on travel within the UK and around the world.

Aon, Allianz, Aviva, Convex, Direct Line, Gallagher, LV, Marsh, Munich Re and Zurich dicuss the future of work

Last week Insurance Post ran its first Future of Insurance Work event which gathered over 40 insurance executives together to share their thoughts on what seems to unquestionably be the hot topic of 2020.

Blog: Don’t lose your data in Excel hell

After an Excel error was blamed for 16,000 coronavirus cases being missed by the Track and Trace scheme, Covernet business development director Jim Campbell considers how insurers, brokers and managing general agents can avoid their own ‘Excel hell’.

Blog: Affirmative cyber - friend or foe?

New technology is bringing unintended cyber losses to non-cyber policies, which typically have not been priced and rated separately, writes Francis Kean, partner at McGill & Partners.

Bought by Many confirms name change outside of the UK

Pet insurance provider Bought by Many will be changing its branding to Many Pets in markets outside of the UK, chief financial officer Luisa Barile told Post.

Applied targets UK market leadership within five years

Applied Systems has a three to five year strategic plan to take “significant market share” in the UK and Ireland and become the market leader in the software sector, according to Europe CEO Andy Fairchild.

Fully Comp episode 4: Can London’s Square Mile bounce back after the pandemic?

Welcome to the fourth episode of Fully Comp, Insurance Post’s new regular video series tackling some of the biggest issues in insurance.