United Kingdom (UK)

Close Brothers partners with Hedron; Howden buys Laurie Ross; Admiral rebrands Toolbox

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

FCA warns insurers to prepare for the ‘techlash’

Nikhil Rathi, CEO of the Financial Conduct Authority, has urged insurers to keep a human hand in the loop, as a “hyper-digitised” future is not for everyone.

Biba’s school initiative ‘trailblazer’ for supporting under-privileged students

Participating schools have praised the British Insurance Brokers’ Association programme for “shaping the future of education and careers” for young people.

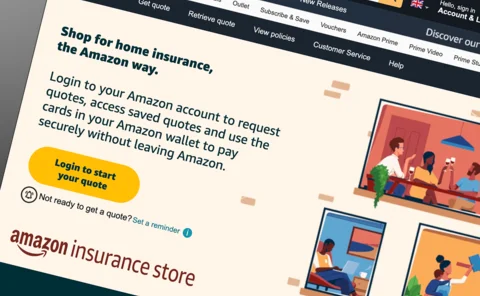

Amazon to close down Insurance Store

Just 15 months after its October 2022 launch, Insurance Post can reveal that Amazon is closing down its UK Insurance Store.

FCA to probe insurers on non-financial misconduct

The Financial Conduct Authority has revealed it is “strengthening its expectations” on how regulated firms consider non-financial misconduct, and will commence a survey to assess the number of cases in financial services.

Insurance must prepare for a rise in deepfake AI fraud

Scott Clayton, Zurich’s head of fraud, shares how rapidly developing technology and digital manipulation threatens to put additional pressure on claims handlers, as deception becomes harder to spot.

Auxillis owner ‘in talks to buy Kindertons’

According to multiple industry sources, conversations are being held for the potential sale of accident management and mobility company Kindertons to Redde Northgate, the parent company of Auxillis.

Climate campaigners claim victory after insurers rule out EACOP

Reinsurance companies Sirius Point, Riverstone International, Enstar Group, and specialty insurers Blenheim and SA Meacock, have all officially ruled out involvement in the East African Crude Oil Pipeline.

Hyperexponential’s CEO highlights next steps after $73m funding round

The insurtech’s CEO and co-founder shares how a “self-sustaining strong foundation” is essential to pique venture capitalists’ interest, and how the funds will fuel its international expansion.

Hiscox CEO highlights what’s next after Google collaboration

Hiscox’s London Market CEO shares why responsible tech development was paramount, and when the firm will roll out its AI underwriting model across the wider industry.

Recruitment challenges leaves a ‘ticking time bomb’ for the industry

Davies has shared concerns that the apprenticeship levy is not being fully used, which is leaving the industry short of fresh talent.

Q&A: Diana Markaki-Bartholdi, The Boardroom

Following the opening of its first UK branch, The Boardroom’s founder, Diana Markaki-Bartholdi speaks to Frances Stebbing about her mission to bridge the gender gap and help more women executives become board members.

Biba teams up with two schools to attract talent

The British Insurance Brokers’ Association has launched a programme to boost diversity and raise awareness of the variety of careers in insurance.

Climate activists threaten to step-up action against insurers

Climate activists have kicked off the new year by warning the insurance sector “your time is up”, and have revealed plans to protest for a “fair and just transition” to secure a liveable planet for all.

Vandals continue to target heritage buildings

Nine out of 10 heritage organisations have experienced crime within the space of 12 months, according to research commissioned by Ecclesiastical.

RSA on why DEI is driven by hard data

Gemma Jackson RSA’s head of DEI shares how the insurer is taking a data driven approach to improve inclusion and build a competitive advantage in the industry.

Insurtech Review of the Year 2023

2023 will be remembered as the year the insurtech funding bubble burst but looking ahead to 2024 players in this part of the market expect providers to realise it is easier to buy systems than build them.

Climate activists paint the city ‘blood red’

Protestors from Money Rebellion, the sister group of Extinction Rebellion, have targeted the offices of UK-based insurance companies in London, Reading, Leeds, Leicester and Colchester.

EITA 2023: Best policy admin software provider Imaginera

Imaginera, a provider of innovative underwriting technology solutions, has been awarded the prestigious Best Software Provider – Policy Administration Award at the European Insurance Technology Awards for its flagship platform, Orca.

’Tis the season to receive claims about Christmas parties

Ho ho ho, it’s the season when alcohol flows and employees let their hair down after a busy year. Frances Stebbing explores what cover employers should have in place to ensure that Christmas parties don’t cause financial headaches.

Howden pleads for protection of climate-vulnerable countries

Speaking at the COP 28 summit, David Howden, founder and CEO of Howden emphasised the power the private sector has to protect vulnerable countries against the effects of climate change and unlock future investment opportunities.

Mapfre calls for AI regulation and improved cyber collaboration

Antonio Huertas, chairman and CEO of Mapfre explained why AI regulation is needed and how cyber continues to leave the industry at a crossroads.

UK develops secure AI guidelines

The UK has published guidelines to ensure the secure development of artificial intelligence technology.

Lloyd’s consults on Net-Zero approach

Lloyd’s of London has launched a consultation among member firms on its proposed approach in insuring the low-carbon transition over the next three years.