Australia

Briefing: QBE makes the only decision on cutting ties with CEO but where will Pat Regan surface next?

QBE will have had little choice but to part ways with CEO Pat Regan after an external investigation concluded his conduct had been unsatisfactory. But the proof in the inclusion pudding for the industry will be whether he resurfaces. And if so, where…

QBE CEO Pat Regan leaves insurer after investigation

Pat Regan, QBE group CEO, will leave the business following an investigation into “workplace communications.”

Registration for virtual diversity event Dive In opens

Registration for diversity and inclusion festival Dive In has opened with over 90 virtual events taking place in over 30 countries from the 22 to 24 September.

QBE warns of $335m Covid underwriting hit for H1

QBE has predicted it will deliver a $750m (£581.7m) post tax loss when its half year results for 2020 are published next month.

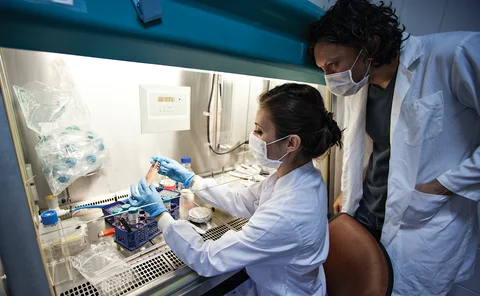

In-depth: How the life sciences sector is supporting the fight against Covid-19

The industry has found itself under the spotlight for all the wrong reasons during the Covid-19 pandemic. However, one area where it should be singing its praises is life sciences. Post investigates how brokers and insurers have supported the quest for…

Sam White launches Australian MGA Stella with £80m target

Pukka-owner Freedom Services Group has teamed up with private equity firm Envest and others to launch Stella Insurance, a digital managing general agent providing female-centric motor insurance in Australia.

Marsh supports partnership between British Red Cross and the British Psychological Society

The British Red Cross and the British Psychological Society have teamed up to recruit specialist Psychosocial Reserve Volunteers who will support people experiencing trauma or emotional distress during and after major emergencies in the UK.

Perils pegs Australian bushfire losses at A$1.86bn

Perils has pegged insurance and reinsurance industry losses for Australian bushfires at A$1.86bn (£1.03bn)

AGCS embarks on €200m cost-cutting restructure

Allianz Global Corporate & Specialty will look to reduce its global headcount by a further 400 as it embarks on a transformation programme.

Profits nearly quadruple at Ecclesiastical in 2019

Ecclesiastical delivered £58m in post-tax profit last year, more than treble the £15.2m achieved in 2018, according to a filing at Companies House.

Insurance Monitor: Past, present and future: Lloyd's, legacies and leaving lockdown

In this month’s column, David Worsfold looks at insurance past, present and future in light of the pandemic and the recent Black Lives Matter protests.

Global recession 'like a car crash without an airbag', says Swiss Re

The global recession triggered by Covid-19 is “like a crash without an airbag” according to Jérôme Jean Haegeli, group chief economist at Swiss Re.

Bought By Many to enter new markets after largest UK insurtech raise of $98m

Pet insurance specialist Bought By Many has secured $98m (£78.4m) in growth equity investment led by FTV Capital, having agreed terms sheets with the US growth equity investment firm and five other potential investors prior to Covid-19 lockdown.

QBE targets $825m raise to shield against Covid-19

QBE is seeking to raise $825m (£655m) in light of the Covid-19 crisis split across a $750m placement with institutional investors and a $75m share purchase plan for eligible shareholders.

Pukka owner Freedom Services Group buys Homelyfe

Exclusive: Freedom Services Group has bought insurtech business Homelyfe from Aventus for an undisclosed sum in a deal that closed last week.

Analysis: Closing the natural catastrophe protection gap

Though losses from natural catastrophes fell in 2019, the proportion of losses that were uninsured rose to a three-year high. Post investigates why.

Interview: Scott Walchek, Trov

One of the original insurtech poster children, Trov recently pulled its personal lines offering in the UK and quickly followed this up by partnering with Lloyds and Halifax on renters’ insurance. Trov CEO and co-founder Scott Walchek sat down with Jen…

Australian insurers face further losses of A$514m as hail hits the country

Insurance losses resulting from severe weather conditions from 19-21 January in Australia, are estimated to be A$514m (£269m), according to the Insurance Council of Australia

Aon names Helene Madell UK chief broking officer

Aon has appointed Helene Madell as chief broking officer for commercial risk solutions, health solutions and affinity in the UK.

This week: It's all about change

Moving home has to be one of the most annoying and tedious things we have to do. From organising your flat viewings to packing up all your belongings. And honestly who really likes change? It’s much easier to just stay in the place you've grown…

Australian regulator warns of insurance scammers in wake of fires

Australians whose property has been damaged by the ongoing bushfires should beware of “fictitious or unscrupulous tradespeople, repairers or firms offering to assist them with their insurance claim”, the Australian Securities and Investments Commission…

Australian bushfire insurance losses surpass £500m

Insured losses resulting from bushfires ravaging the Australian states of New South Wales, Victoria, Queensland and South Australia are estimated to have reached A$995m (£524m), according to the Insurance Council of Australia.

This week in Post: Back to business

With the holiday break over, this week has seen people across the UK – some somewhat sluggishly – get back to business.

Integro rebranded as Tysers and RFIB deal completes

Integro has completed the rebrand of its trading names as Tysers, having bought the broker in June 2018.